Why did cryptocurrency exchange Binance create $BNB, also known as Binance Coin, and what is it for? "As one of the world's most popular utility tokens," the company claims, "not only can you buy or sell BNB like any other cryptocurrency, but BNB comes with a wide range of applications and benefits." Hedgehog correspondent Ricky Carroll took a closer look.

What is Binance Coin?

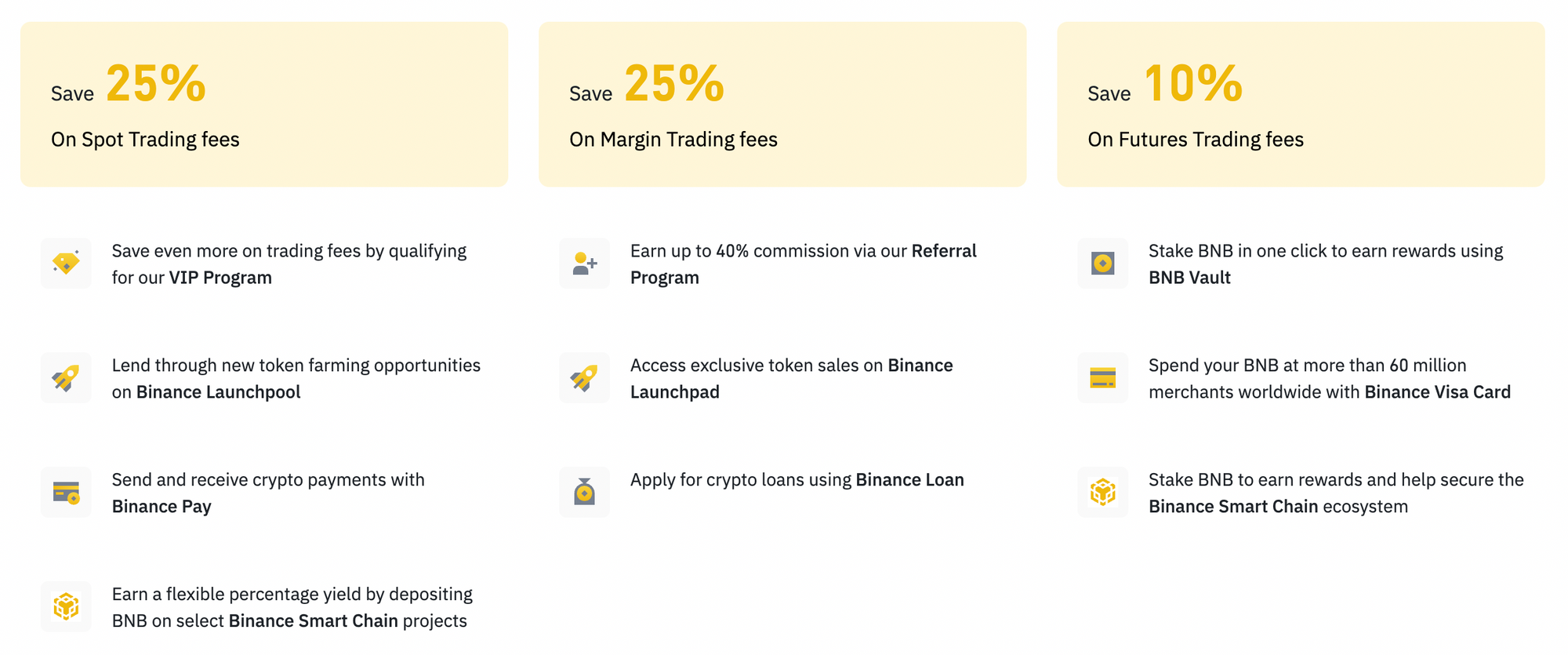

Binance Coin (BNB) is a cryptocurrency built on the Ethereum blockchain. It's been an eventful journey since BNB was introduced by the exchange in 2017. Initially, BNB was considered and used only as a discount coin on the platform, but that would change in the future. Nowadays Binance Coin includes a variety of perks for crypto traders using the exchange, including exclusive token sales and returns from staking:

Binance is known for listing new cryptocurrency projects quickly, and traders are encouraged to use BNB to access those investment opportunities. Tokens appear on the exchange alongside a complete marketplace for trading. Having a native coin such as BNB reduces the dependency on traditional fiat money, avoiding the inconvenience of extra security checks and fees, which place a burden on the end-user. Binance leverages BNB to offers its users a seamless experience. The exchange also benefits from encouraging funds to flow into and through the Binance ecosystem.

Recent performance

The debut and development of Binance Smart Chain unlocked phenomenal growth for BNB, with a price of $460 each at the time of writing. However, it's been a choppy year for the cryptocurrency market in general, and Binance Coin in particular has seen big swings in price throughout 2021:

Despite the volatility since January, it's obvious in hindsight that BNB was a great buy at the beginning of the year. What made the price of Binance Coin bounce so much, aside from the state of the broader market? Well...

Regulatory trouble

The phenomenal growth of the Binance network and its native coin has resulted in attention from regulators in America and Singapore, to name just two. The scrutiny from these regulators has seemingly prompted the network to stop offering futures and derivatives in certain parts of the world. Binance will be hoping to stay on the right side of regulators in the future.

US regulatory bodies have accused Binance of insider trading. No charges have currently come against the platform. However, these accusations are the type of negative press the group will be desperate to avoid following the May outage due to a technical issue. The platform could still face legal action from customers looking for $20,000,000 compensation in some cases due to the May outage.

Future of Binance Coin

Binance Coin experienced a growth in 2021 by up to 20x its original size. The progress in 2021 for Binance Coin has been exponential. With the ambition of the chain and company backing it, we can expect more big moves in 2022.

The rate at which BNB is closing on its competitors reflects the rapid growth of Binance as a crypto exchange. BNB has shown an ability to ride through the peaks and troughs of the crypto market — suggesting all aspects of Binance are here to stay and fight. Before the recent negative headlines and sell-off in the crypto market, the future for Binance Coin was looking prosperous. Will the price reach $1000 again? If you think so, give BNB a whirl.

Check out Ricky's website, follow him on Twitter, and of course sign up for Hedgehog's weekly newsletter!