Hi, this is Taylor, CEO of Hedgehog, the platform that makes it easy to manage your entire cryptocurrency portfolio in one place. Today is Thursday, the week is almost over, just enough time for a wham-bang finish! Let's get it.

Only rundown #2 and I already have a lot to share. Bear with me as I figure out how much to focus on Hedgehog versus the broader crypto ecosystem. I definitely want to talk about both! The modern challenges of a hungry young company and a hungry young ecosystem have some natural overlap. I hope to pique your curiosity — crypto is a truly fascinating space on multiple levels.

By the way, thanks for the encouragement so far, I appreciate it!

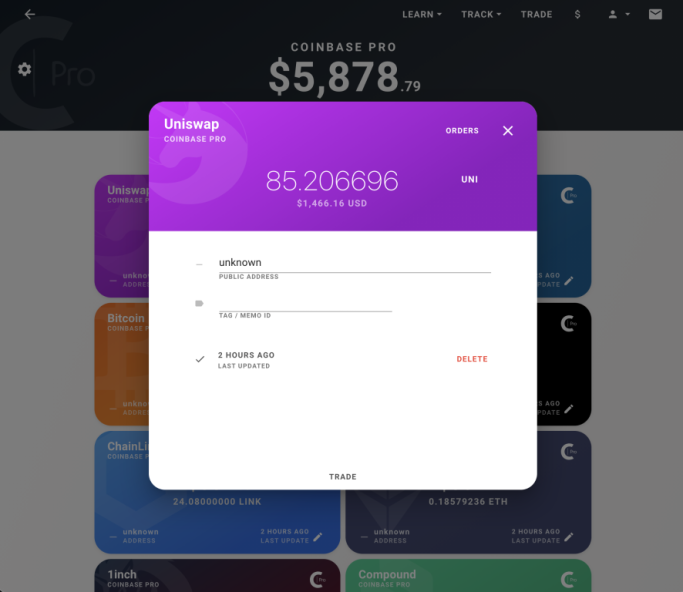

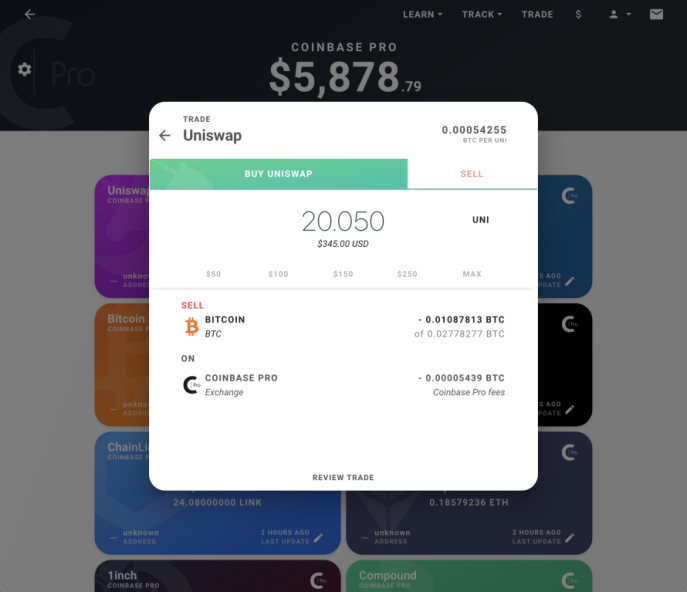

My team is always working on new features. Something cool we shipped this week: Trading directly from a particular address! Try it out.

One of our constant behind-the-scenes priorities is improving the experience of connecting wallets and exchange accounts to Hedgehog. For obvious reasons, we want it to be as smooth as possible to unlock the full value of the platform. We invest a lot of time and effort into oiling that lock, so to speak.

We're eager to help with DeFi in the near future. What tools are you using currently, and what is still a hassle? Hit reply to let me know. Hearing from you guys is 1) awesome 2) essential for my team 3) apparently deadly for my inbox. Our trading roadmap has been heavily influenced by feedback from early users, and we couldn't do this without your help and enthusiasm!

By the way — Ledger raffle #1 was fun, let’s do it again! We got in touch with the first winner and will reach out to the second one soon. After that I think we'll experiment. It would be cool to reward the Discord community — naturally, you're still invited to join!

I want to share some reads that I think are worth your time, with the caveat that I can't 100% vouch for the accuracy of specific info. Be skeptical, verify before trusting: "Above all, what's essential is keeping your wits about you." Remember that!

- "Crypto for People Who Don't Follow Crypto: A normie-friendly, buzzword-free argument for why crypto will change the world." This guide was written by tech media OG Jon Stokes, who co-founded Ars Technica. There can never be enough newbie-oriented intros, send it to your friends!

- For a more advanced overview of wtf is going on, try Messari's "Web3 & NFT Q2'21 Report."

- "With PoolTogether, anyone can deposit DAI, USDC and other tokens into the application, and the protocol 'pools together' all of the deposits and puts it to work on a lending protocol (like Aave or Compound). Then every week, the protocol randomly distributes all of the interest to one lucky winner." Neat design!

- Binance woes: "Compliance is a journey," says the CEO. Indeed, it appears to be an ongoing one 😢 "Although Binance Holdings Ltd. turns away American customers, it is now said to be facing probes from U.S. agencies," per Bloomberg.

- "Over the weekend, a @CasaHODL client survived a '$5 wrench attack' — he was drugged and persuaded to give up access to phone, accounts, and passwords. With the client's permission, we are sharing the story to help others learn to protect themselves." Casa CEO Nick Neuman told this sobering tale on Twitter.

Over the weekend, a @CasaHODL client survived a “$5 wrench attack” - he was drugged and persuaded to give up access to phone, accounts, and passwords. With the client’s permission, we are sharing the story to help others learn to protect themselves.

— Nick Neuman (@Nneuman) July 8, 2021

🧵👇

- "American Express is dipping a toe into the world of digitally traded art with its newest perk for credit card customers," American Banker reports. "The company is offering its cardholders a chance to purchase 14 unique digital images from a recent performance by the R&B singer SZA." Best part: "Amex is anticipating that NFTs will become more mainstream and develop into a desirable perk for prospective customers." My take? It's a PR stunt so Amex can feel like a hip, with-it brand even amongst all the up-and-comers — but that's great! If Amex wants to invest in possible futures that might pay off, hell yeah.

- "ChainSwap has suffered another exploit. A hacker found a vulnerability in the decentralized exchange's smart contract code last night. It gave them a way to access the protocol and sell tokens available on ChainSwap via other exchanges." Yikes!

- To follow up on yikes, how about, uh, wow? ShibaSwap shenanigans:

$SHIB holders can provide liquidity or "dig" for $BONE reward tokens. They can stake or "bury" tokens to farm yield (return rates have not yet been announced). Users can also play "fetch," by migrating their UNI V2-LP or SLP tokens to ShibaSwap in order to earn extra $BONE.

Eventually, ShibaSwap users will also be able to access a "Bonefolio" to check their "dogalytics."

If all of this sounds incredibly lame, now would be a good time to mention that within 48 hours of their July 6 launch, ShibaSwap already has 1.4B TVL, or roughly half of Sushiswap's 2.9B TVL.

- From our investors at Dragonfly Capital, an examination of thorny issues posed by scaling Ethereum.

- Huh:

Crazy how fast BTC on Ethereum is growing

— Brady Dale (@BradyDale) July 7, 2021

via @christine_dkim pic.twitter.com/4nbGg1wxj2

- Last link is a fun one! "DNA is the world's most widely-deployed programming language; each of your cells has up to 10 million compilers. The code varies from highly redundant to weirdly reliant on strange hardware hacks, and nothing is documented," Byrne Hobart explains. "Actually reading and manipulating the genome is the real-world equivalent of buffer overflow glitches in video games like this one. The source code of life can be viewed while the process is running, which is extraordinary." Incredible stuff! And if you can believe it — I bet you can — there are business opportunities there.

Catch you on the flip side.

— Taylor