One of the big draws of crypto is that it allows for complicated financial tools to be used by anyone. It’s one of major attributes that first drew us to the space. From our time building Acorns, we were immediately excited about applying instruments like portfolio management.

For 74% of Crypto users, crypto was their first investment. 65% of crypto users have accounts on 3 or more exchanges, and our beta users are tracking addresses on an average of 9–12 wallets.

With that in mind, the problem with bringing complicated financial tools to unfamiliar users, is that they’re…well…complicated. Portfolio management and rebalancing are inherently complex, heavily deponent on algorithms, and difficult to understand.

So we took a top-down approach. If we want to help a user manage a portfolio, we have to start with helping a user understand what’s in their portfolio first. Then we can start helping a user figure out both what they should do and what they’ve done in the past.

What we’ll go over:

First we will help you understand what an asset does through our Market, Coin, Discover, and News pages.

After creating an account, our Wallet, Address, and Portfolio pages keep track of what you currently have.

Asset Classes, Strategies, and Allocations can help you figure out what you want to have.

Rebalancing tells us how to go from what you have to what you want to have.

Our Trade and Order pages allow you to execute your plan and balance your portfolio.

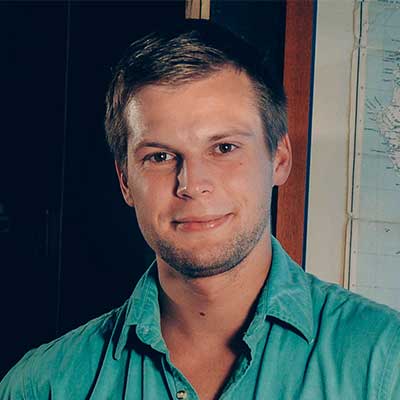

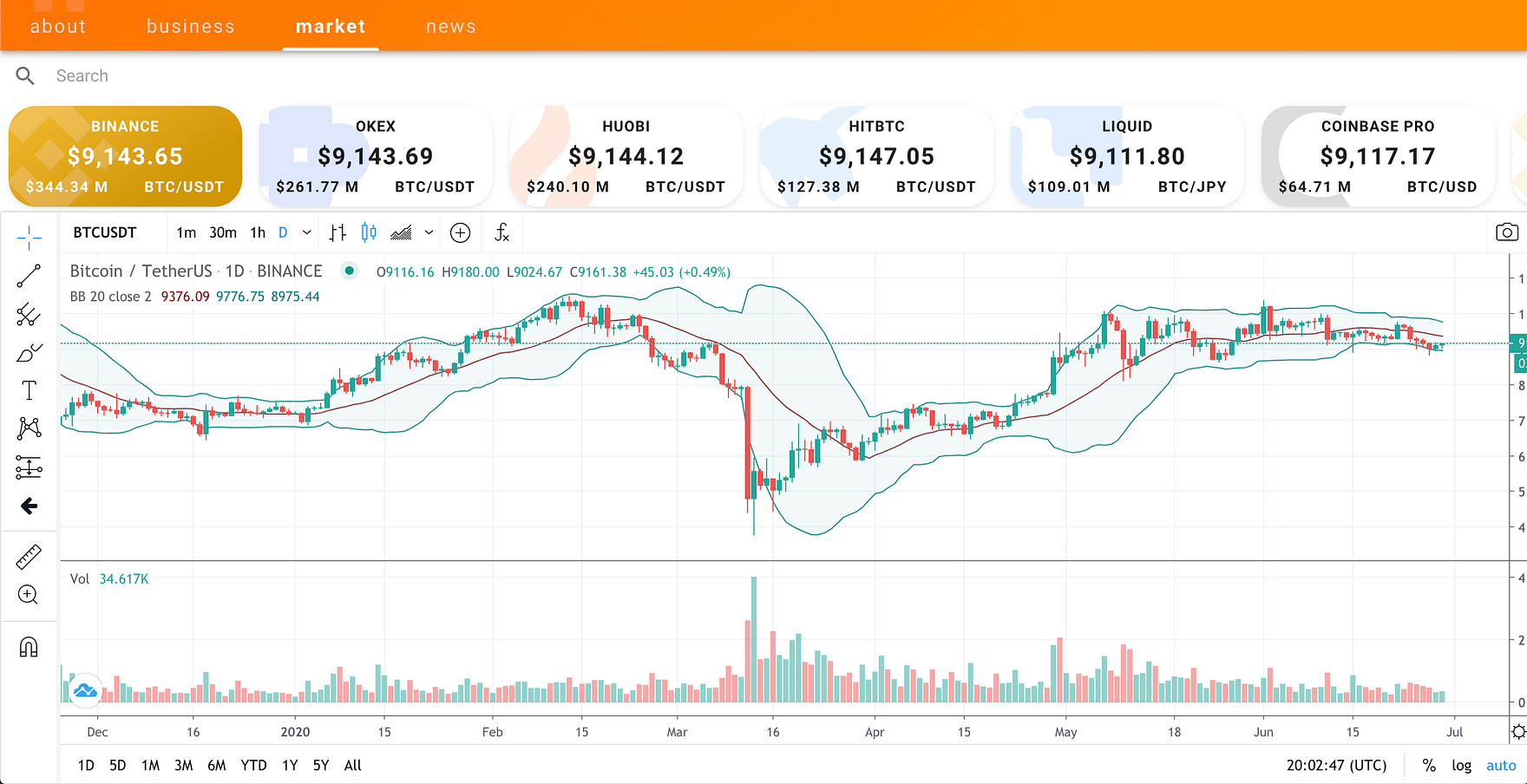

MARKETS

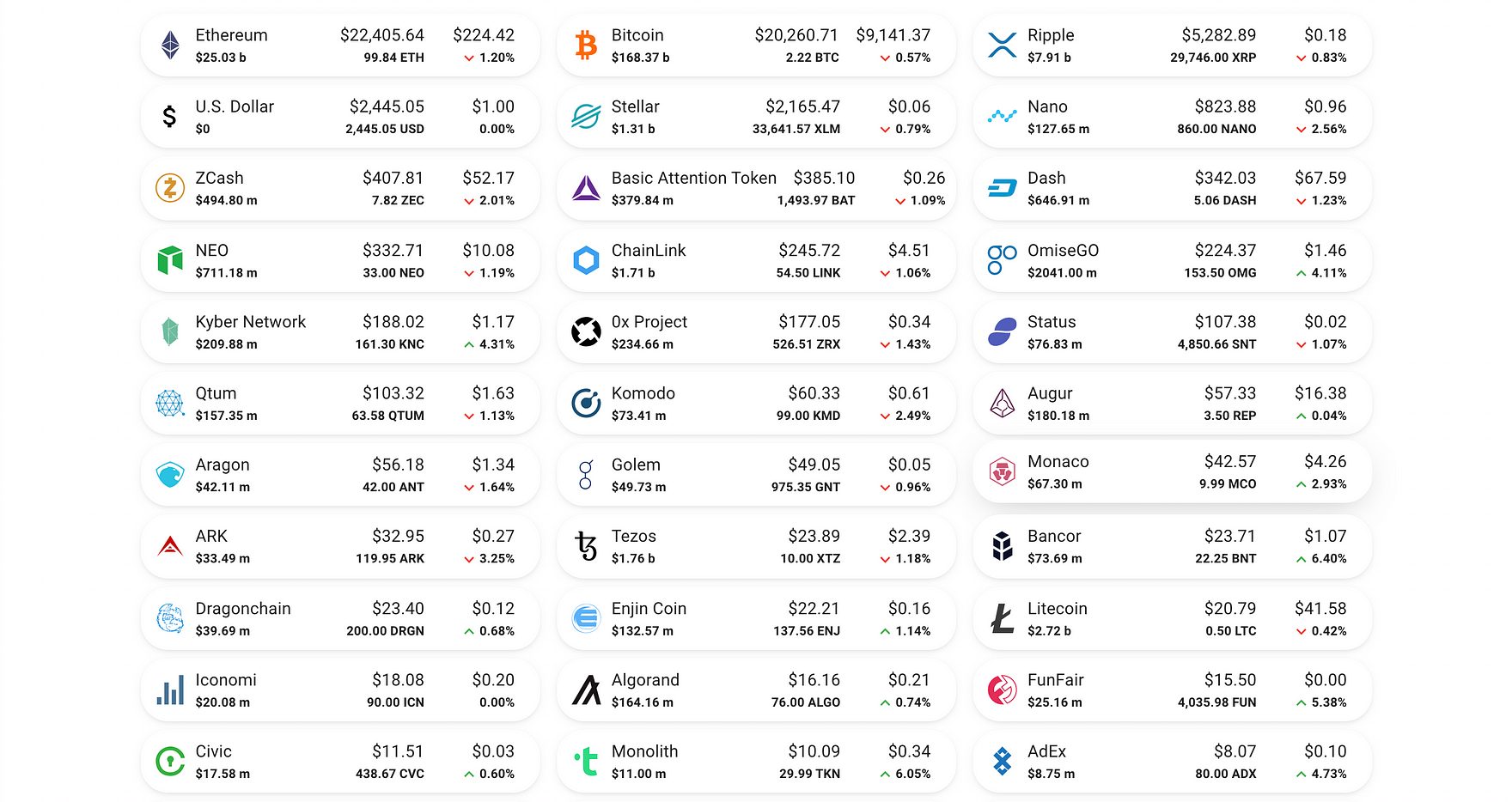

This is the main view of the public app. It offers a familiar market view to showcase the current state of the market. Coins can be sorted by market cap, daily active users, and daily transaction count.

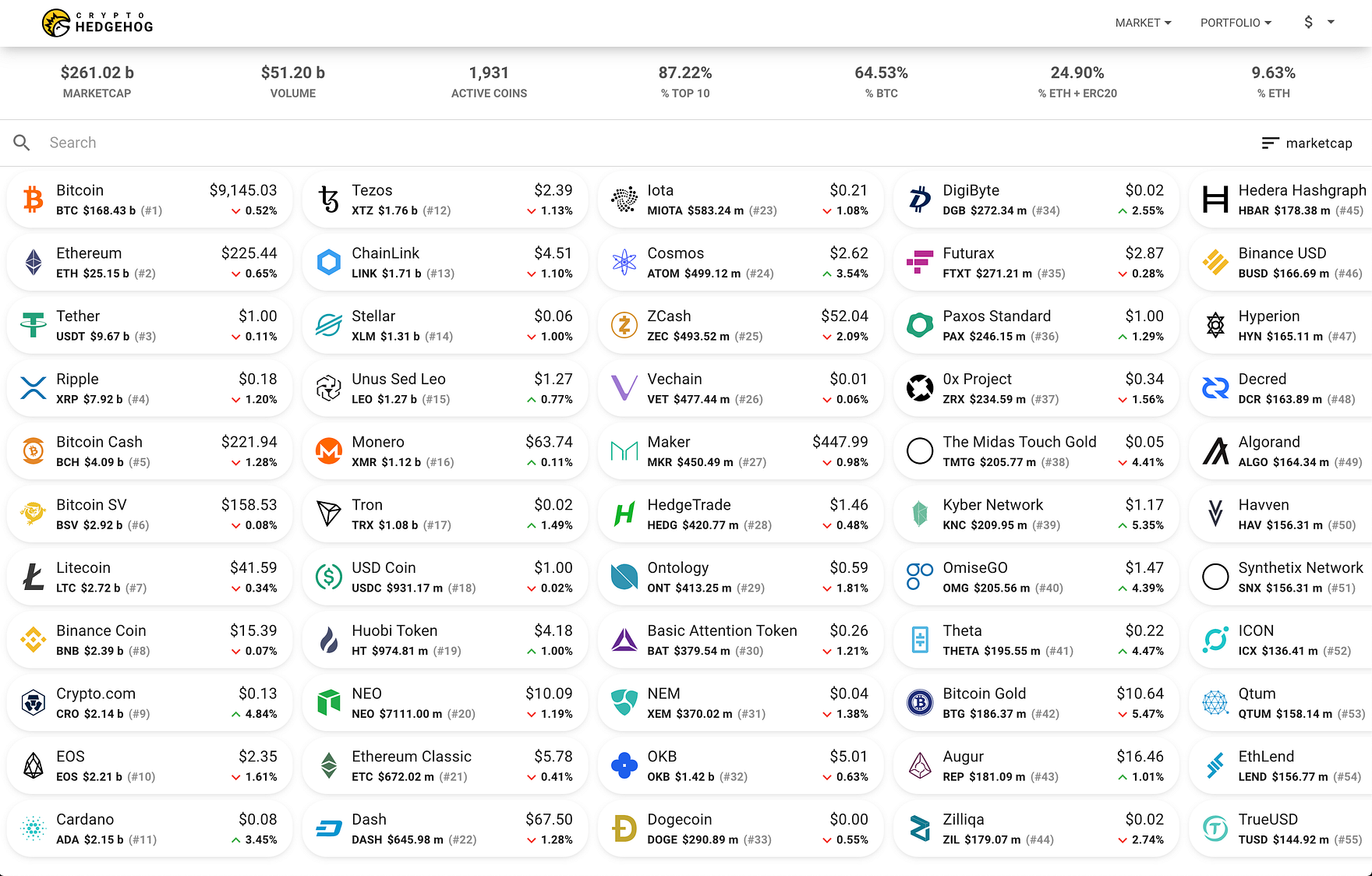

COIN PAGES

Selecting any asset will offer deep-dive information about each coin. From what a coin does, how it works, and media related to the asset, to team composition and available wallets. This helps a user get a better idea about what they might be investing in, and where it can be stored.

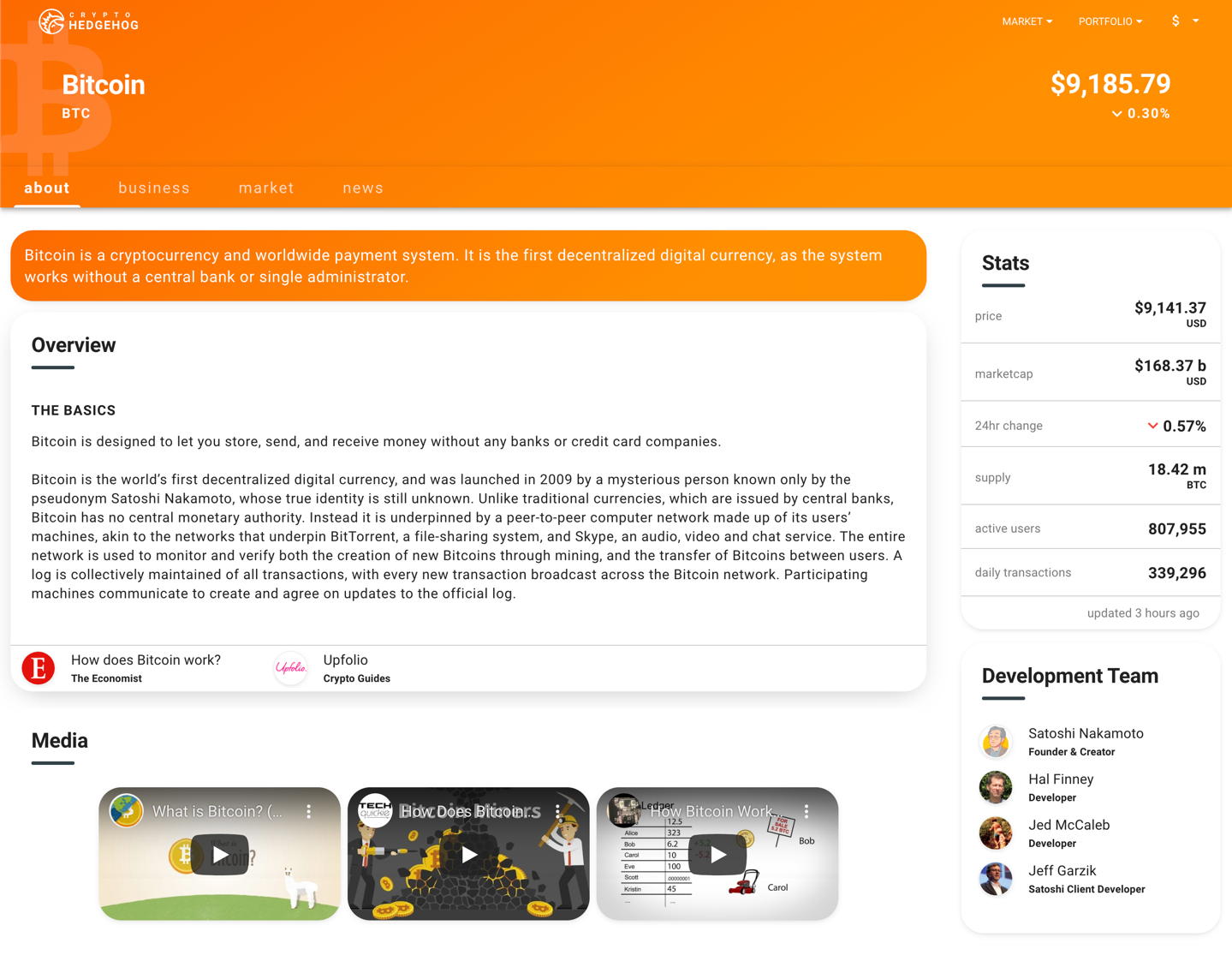

Business

The Business section of a coin page features partnerships, investors and ICO Information (if available). Most of this information was personally added by our team, and is sourced directly from coin websites, press releases, and social feed announcements.

Market

A coin’s market page shows the top 100 trading pairs associated with that coin, sorted by volume. Selecting a pair will load its associated chart from either Tradingview or Crypto Watch.

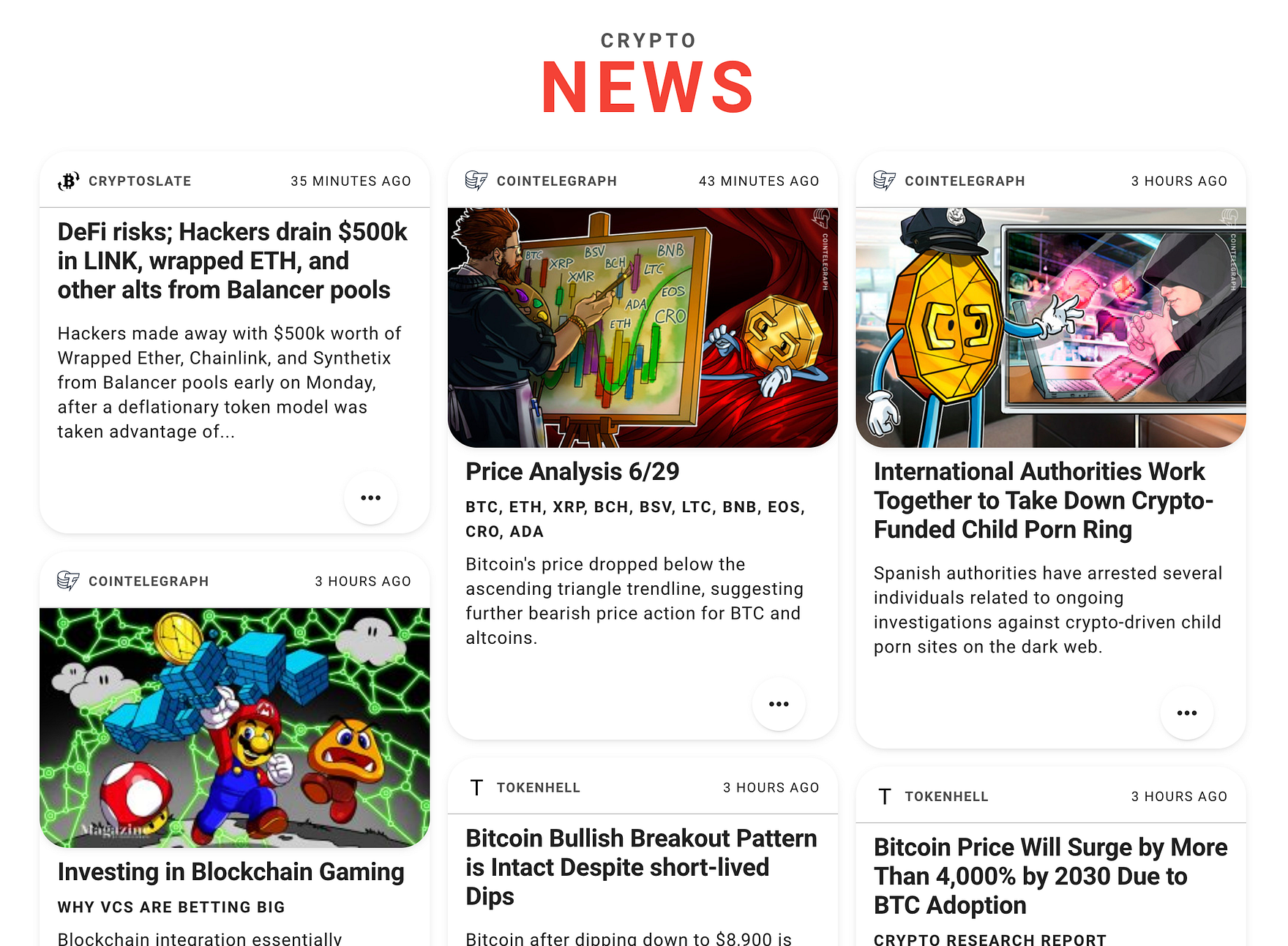

NEWS

Our news page collects all the news from the top crypto sources, and displays it. Each coin page also has a news section, with additional feeds that are specific to that asset.

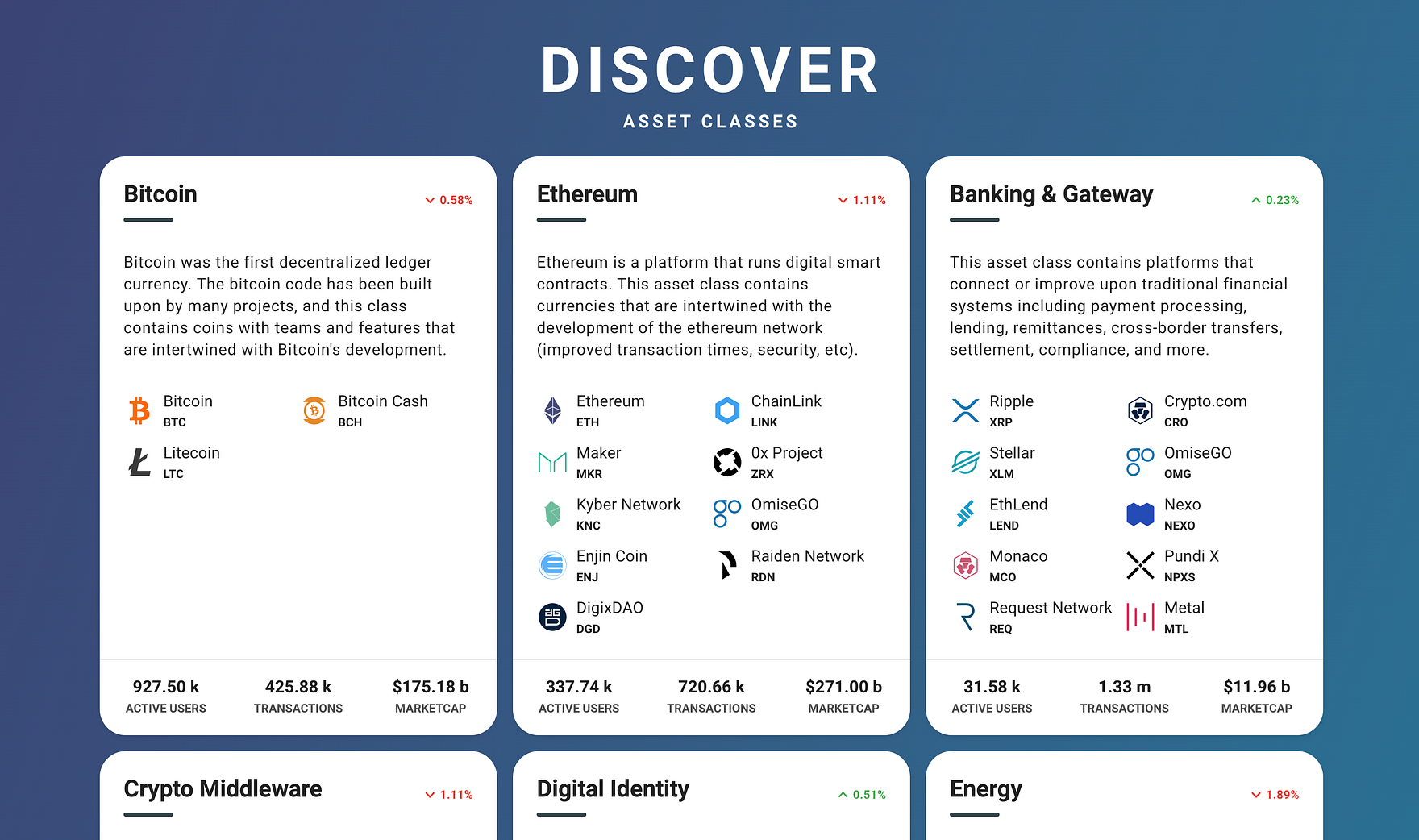

DISCOVER

Discover offers a personally curated list of assets, separated by asset class. Assets here are grouped based on their primary function, from Banking and Privacy centric coins to Gambling, Gaming, and Advertising.

Next we want to help you get a better idea of what you already have.

CREATING AN ACCOUNT

Registering is pretty easy. We require a username, email, and strong password. Once you’re registered, you can validate your email, and enable two-factor authentication.

Once you’re logged in, you can start assembling your holdings.

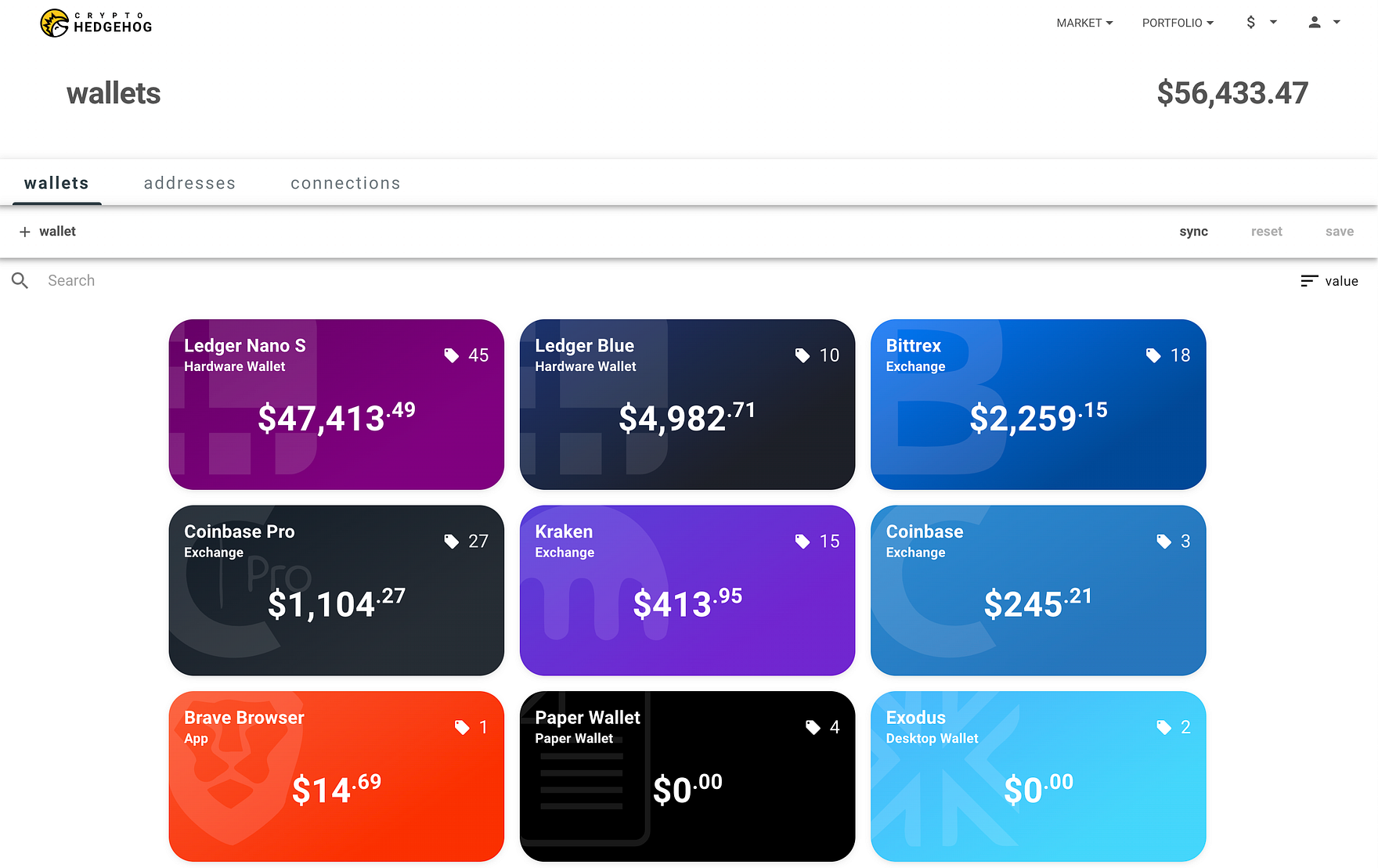

WALLETS

Wallets are the places where your crypto is stored, and includes exchanges, hardware wallets, apps, crypto credit cards, and more. We currently track over 400 different wallet locations, and offer a Paper Wallet as a fallback in case what you’re looking for hasn’t been added to our system yet.

Adding a wallet to your account is simple, and wallets can be added or deleted whenever you want.

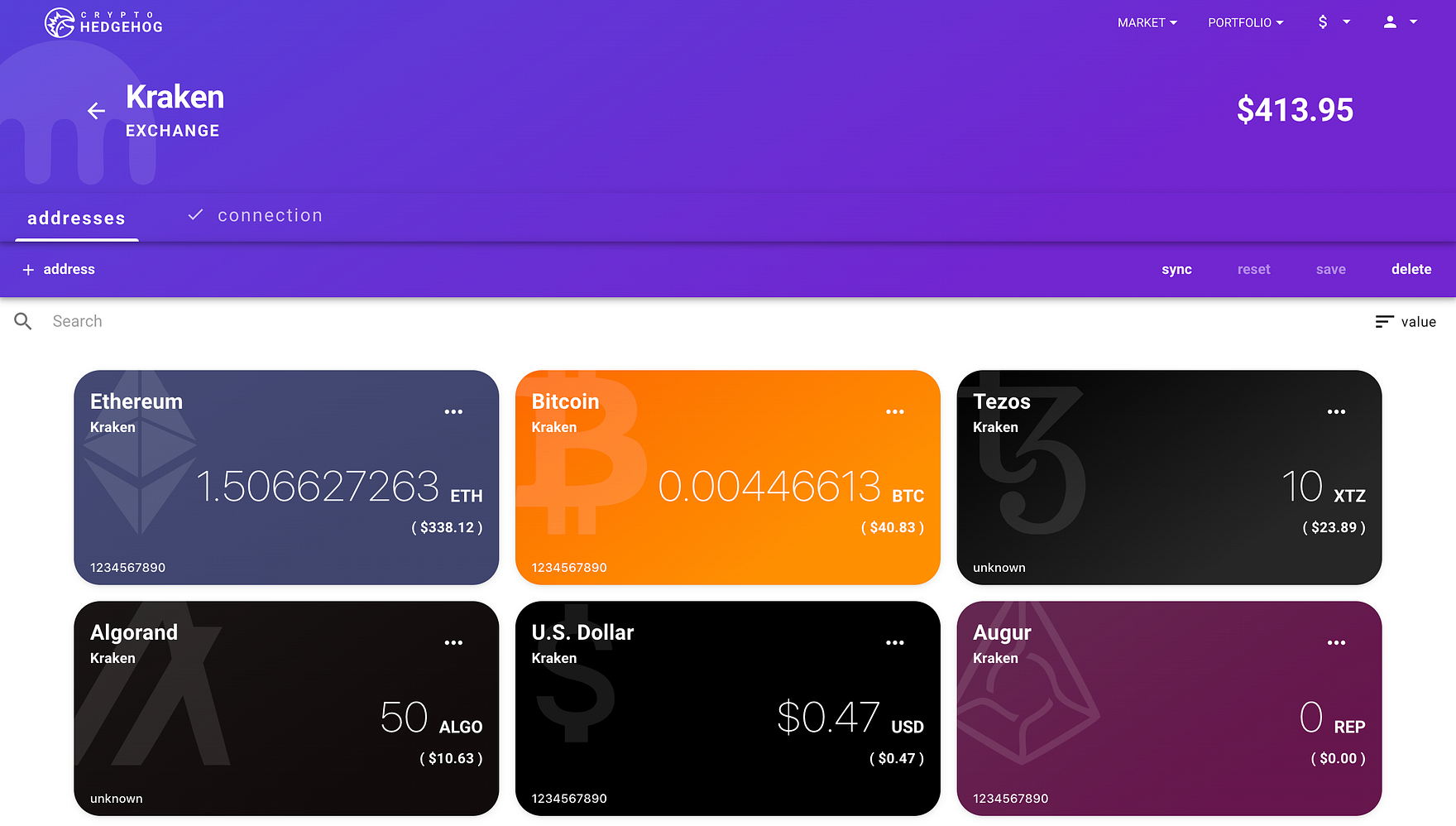

ADDRESSES

Your addresses are associated with a specific wallet. Depending on the location and the asset, we’re able to automatically sync your balances behind the scenes. Currently, we support API connections with over 120 exchanges, and on-chain syncing for over 1200+ assets (based on your public address).

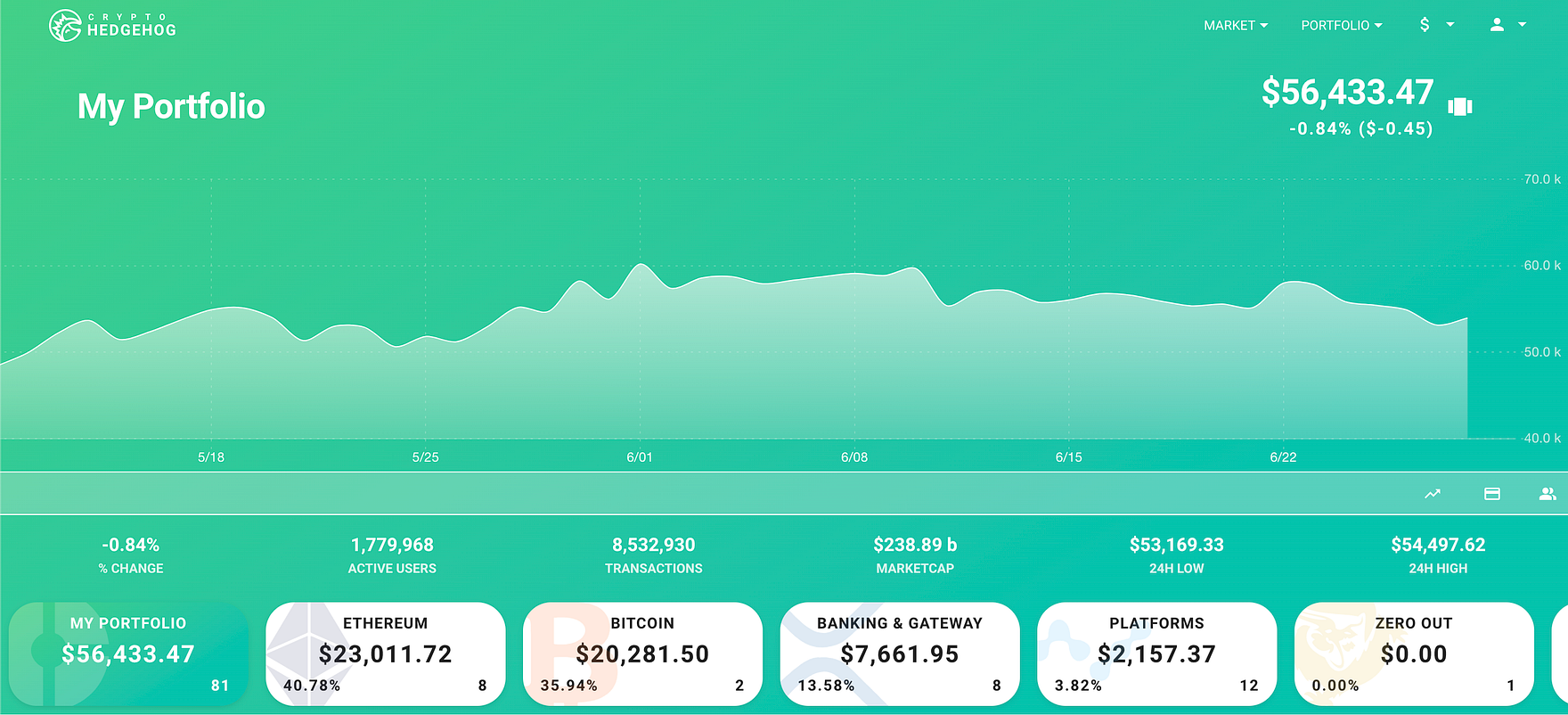

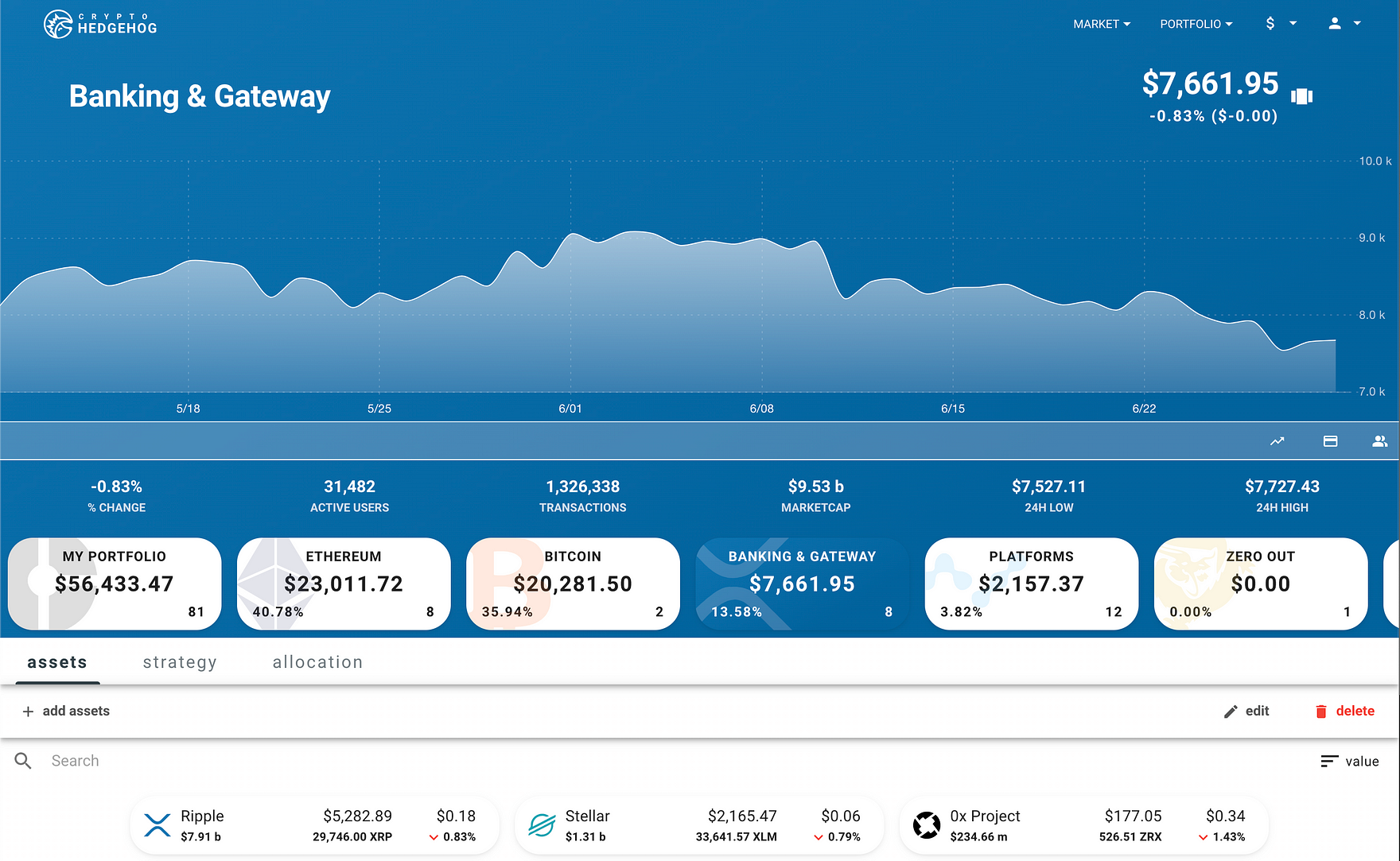

PORTFOLIO

Once you’ve added your wallets & addresses, you’ll have an up-to-date view of your entire portfolio.

So far, our public research pages have allowed you to better understand what an asset does, and once you’ve logged in, you can track and sync all your wallets and addresses for a better understanding of what you already have.

Now the fun part begins. Next we want to understand what you want to do.

ASSET CLASSES

Within your portfolio you can create asset classes. Asset classes can help you identify and group assets that behave similarly. Asset classes can be added or deleted at anytime, and are fully customizable.

Strategies

Within each asset class you can set strategies for how you’d like to weigh those assets. For instance, selecting a “market cap” strategy will compare assets based on their current market cap, offering a target guideline for how much of an asset you should have in your portfolio.

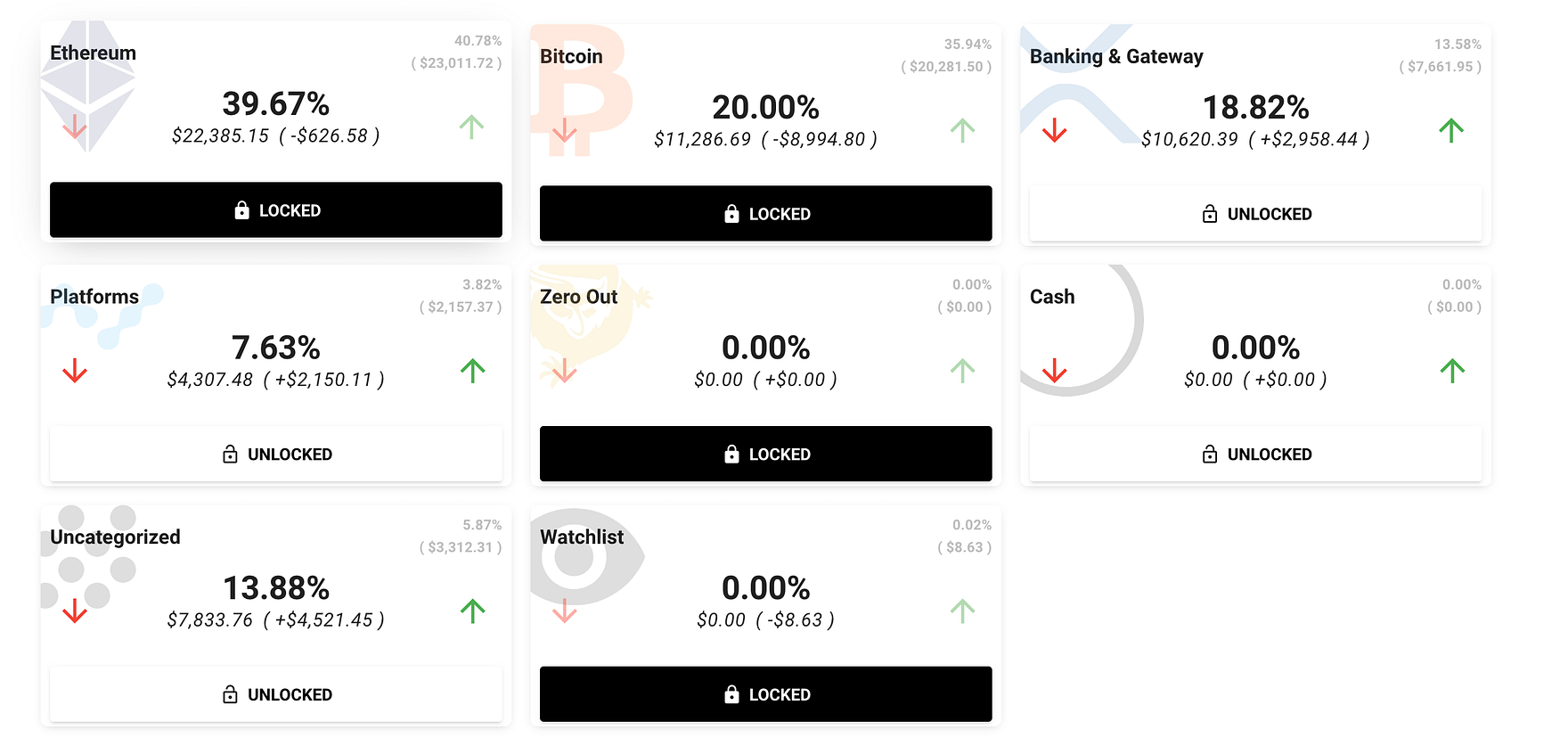

Investment Allocations

With your strategies set, we’ll know the percentage of each asset you’d like to have within each asset class, and how to allocate an asset classes funds correctly. But how much of your portfolio should be devoted to an asset class?

Generally, there are two paths to take. Either you want an asset class to be a fixed percentage of your portfolio, or that percentage should be variable and based on certain settings. On Crypto Hedgehog, users can do both.

Our Banking & Gateway, Platforms, Cash, and Uncategorized asset classes all have variable percentages based on the overall market cap of their assets. So if the combined market cap of every asset class stays the same, but the market cap for Platforms increases by 10%, then we would want to allocate an additional 10% of your portfolio funds to Platforms, and decrease our allocation in the other classes equally.

Phew! That’s a lot of stuff to absorb so far. Asset Classes, Strategies, and Allocations are a critical part of finance, but the ever-changing relationships and percentages can be a lot to process and keep track of. Hopefully this helps you get a better handle on it, but we’re always trying to make it easier and more intuitive. Feedback is always welcome!

But now that we know what you want to do, let’s figure out what you SHOULD do in-order to achieve your ideal portfolio.

You know what you’re investing in, you know what you already own, and you know what your ideal portfolio looks like. So how do you go from what you currently have, to what you should have? Rebalance.

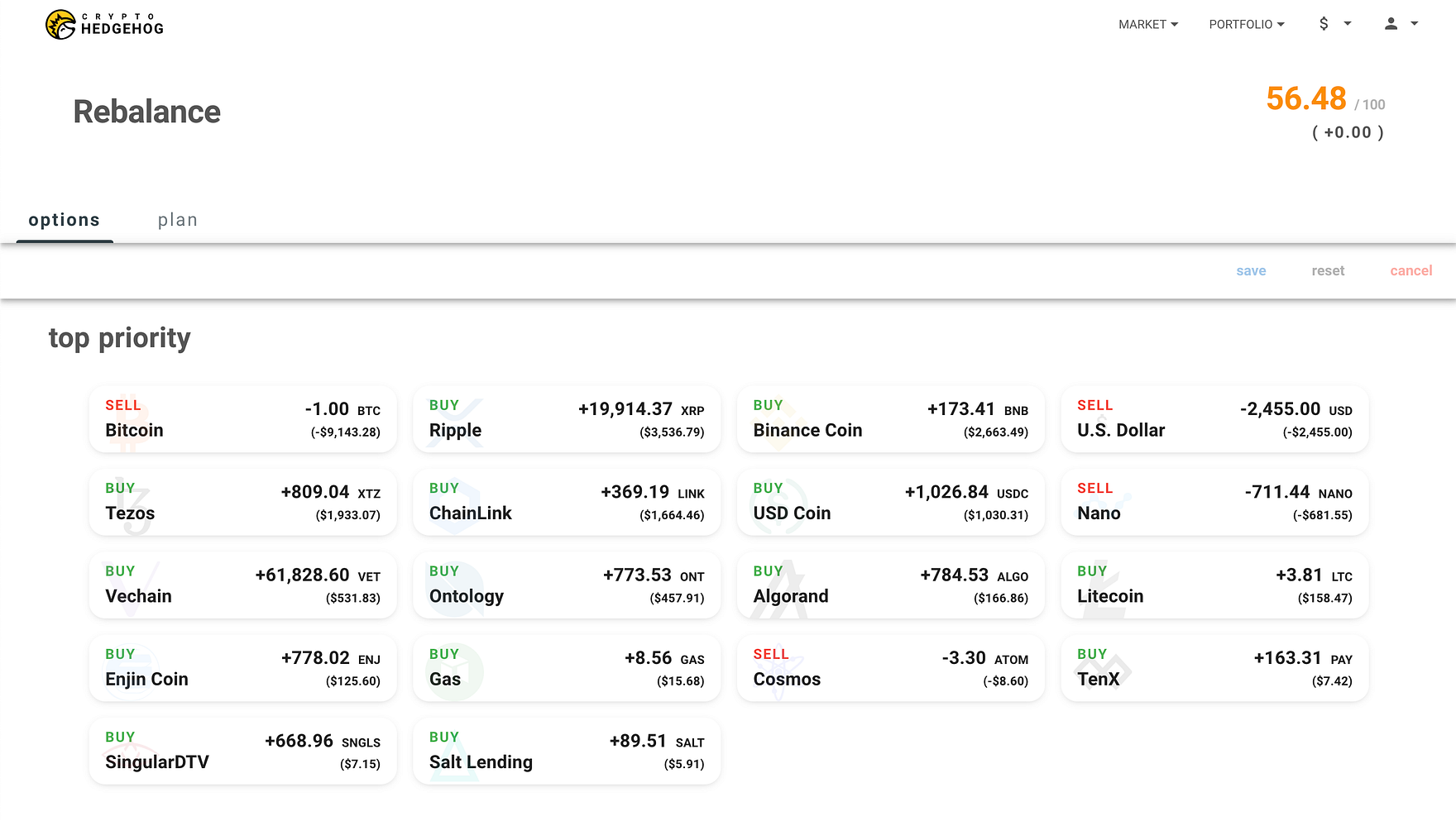

REBALANCE

Once you’ve setup your portfolio and configured your asset classes, strategies, and allocations, we’ll be able to tell you what assets you own too much of and what you own too little of. This is often referred to as being “over exposed” or “under exposed” to an asset.

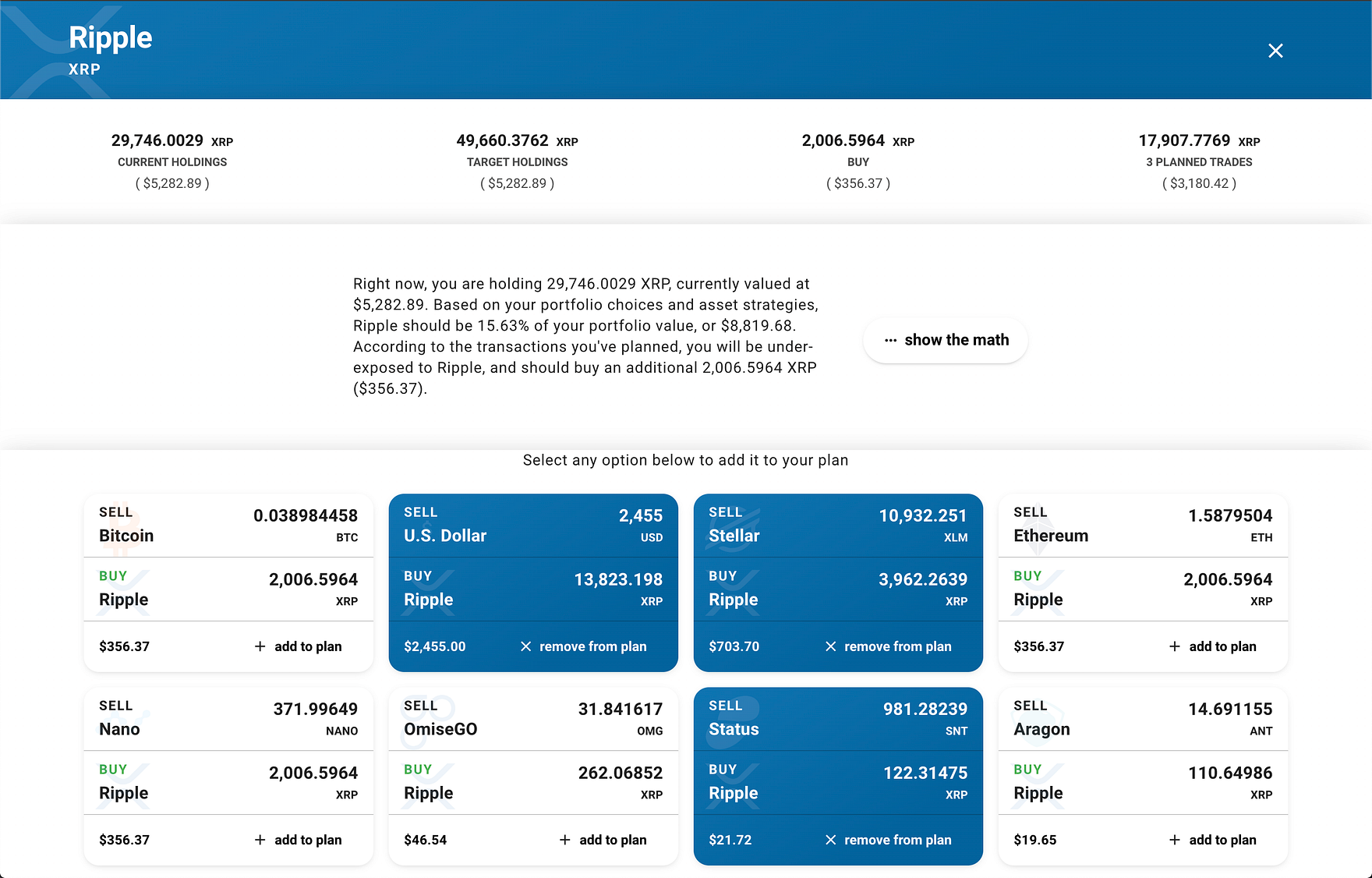

Rebalance Targets

Selecting XRP brings up some additional details, including your current holdings, target holdings, and recommended trades. For this example, we need to buy 2,000 XRP, and some options for how to achieve that are offered (with the goal being to sell assets that are over-exposed and buy assets that are under-exposed).

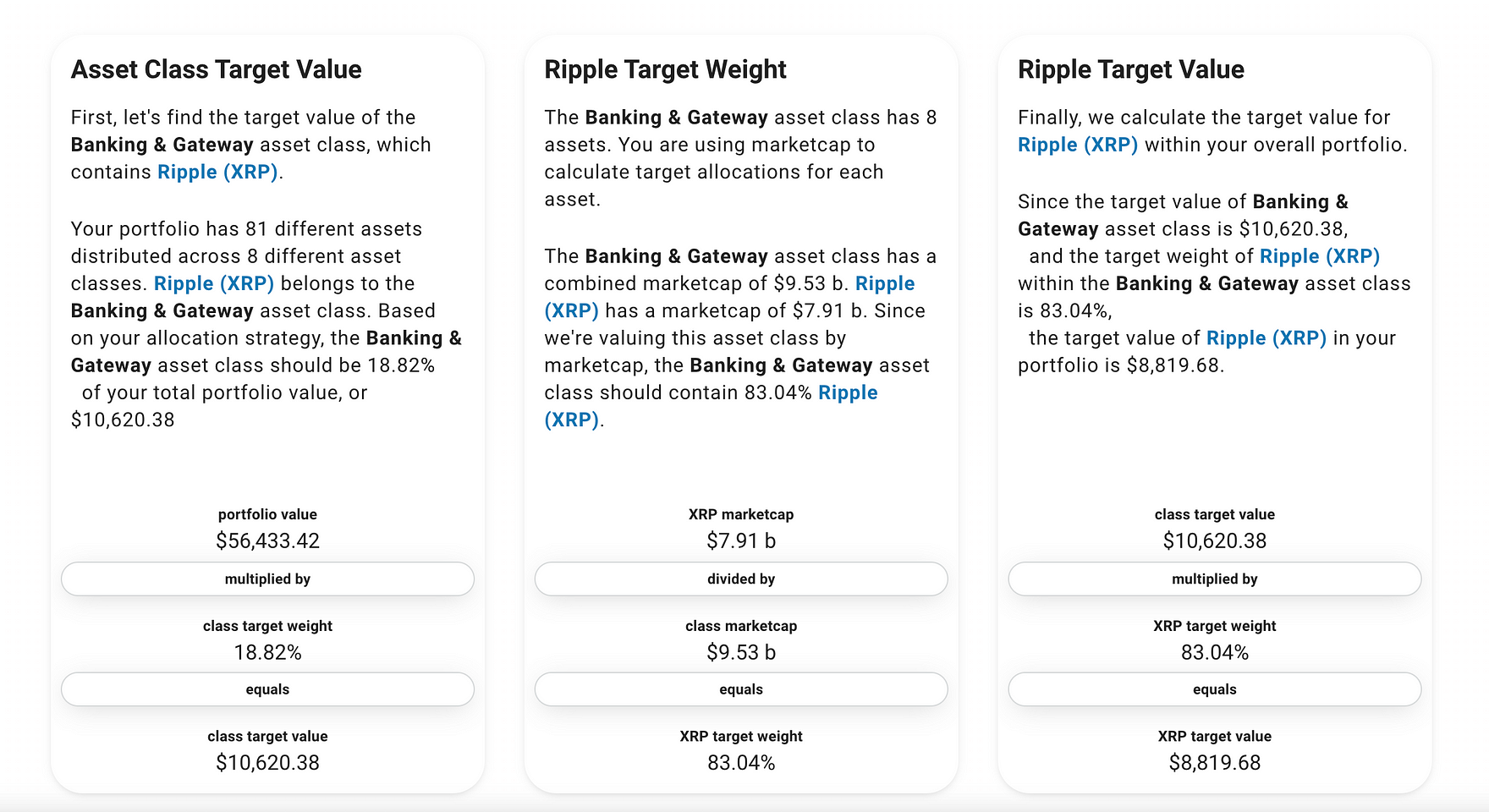

The Math

Interested in the math behind the recommendation? By clicking “show the math” we’ll break down exactly how the results were tallied.

Okay! The hard part is complete. You know what you’re investing in, have a clear picture of what you already own, know what your ideal portfolio looks like, and built a plan for how to get there. The last step is…well…actually placing trade.

TRADE

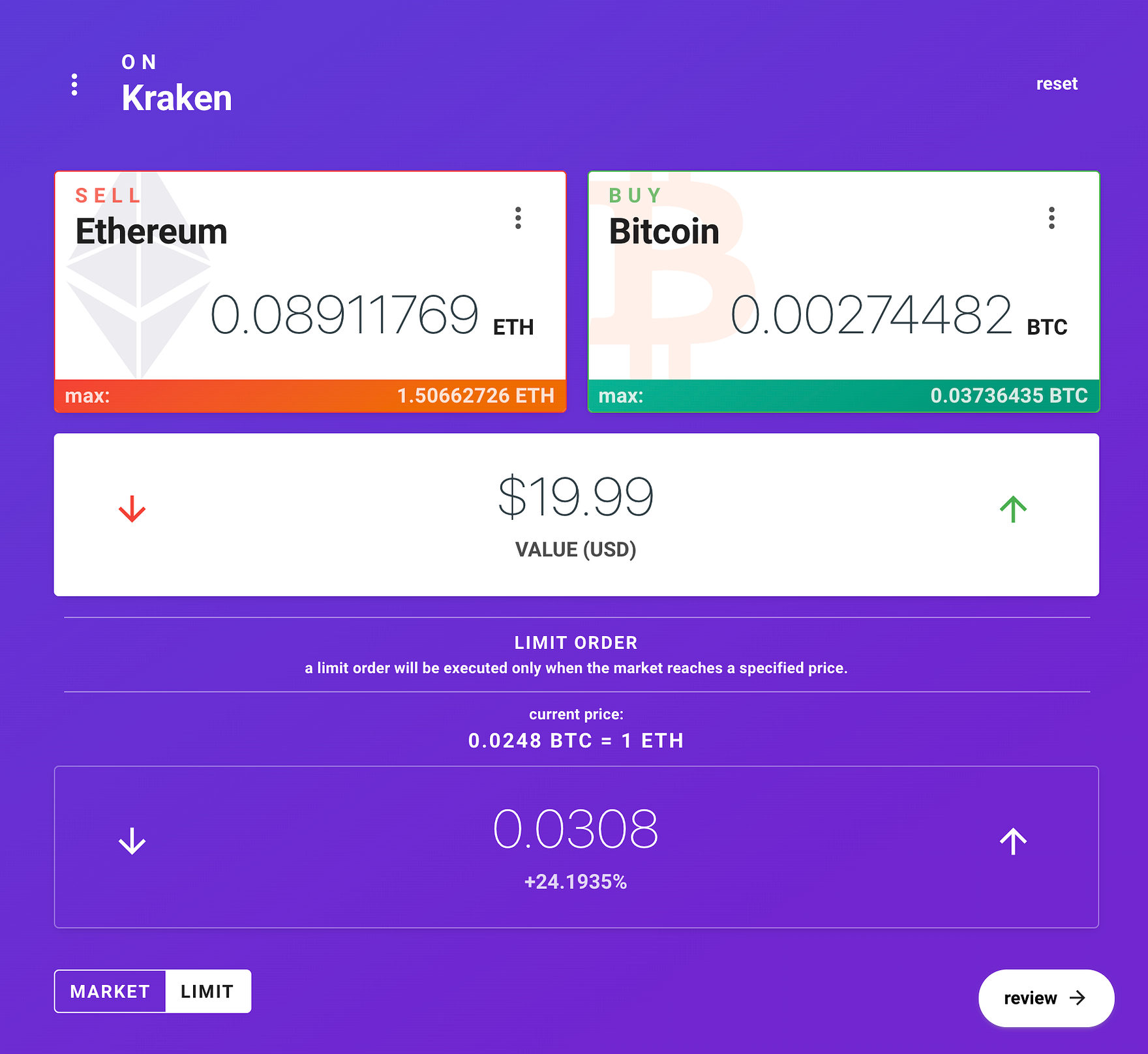

Trading provides a unified interface for all of your connected exchanges, and presented a unique opportunity to re-think trading. We wanted to get away from the classic trading screens, and focus on being able to quickly switch exchanges and markets.

Being able to swap currency inputs without changing what your trading was important to us. We wanted users to be able to sell one asset for another without needed to calculate how much that trade is worth in their base currency.

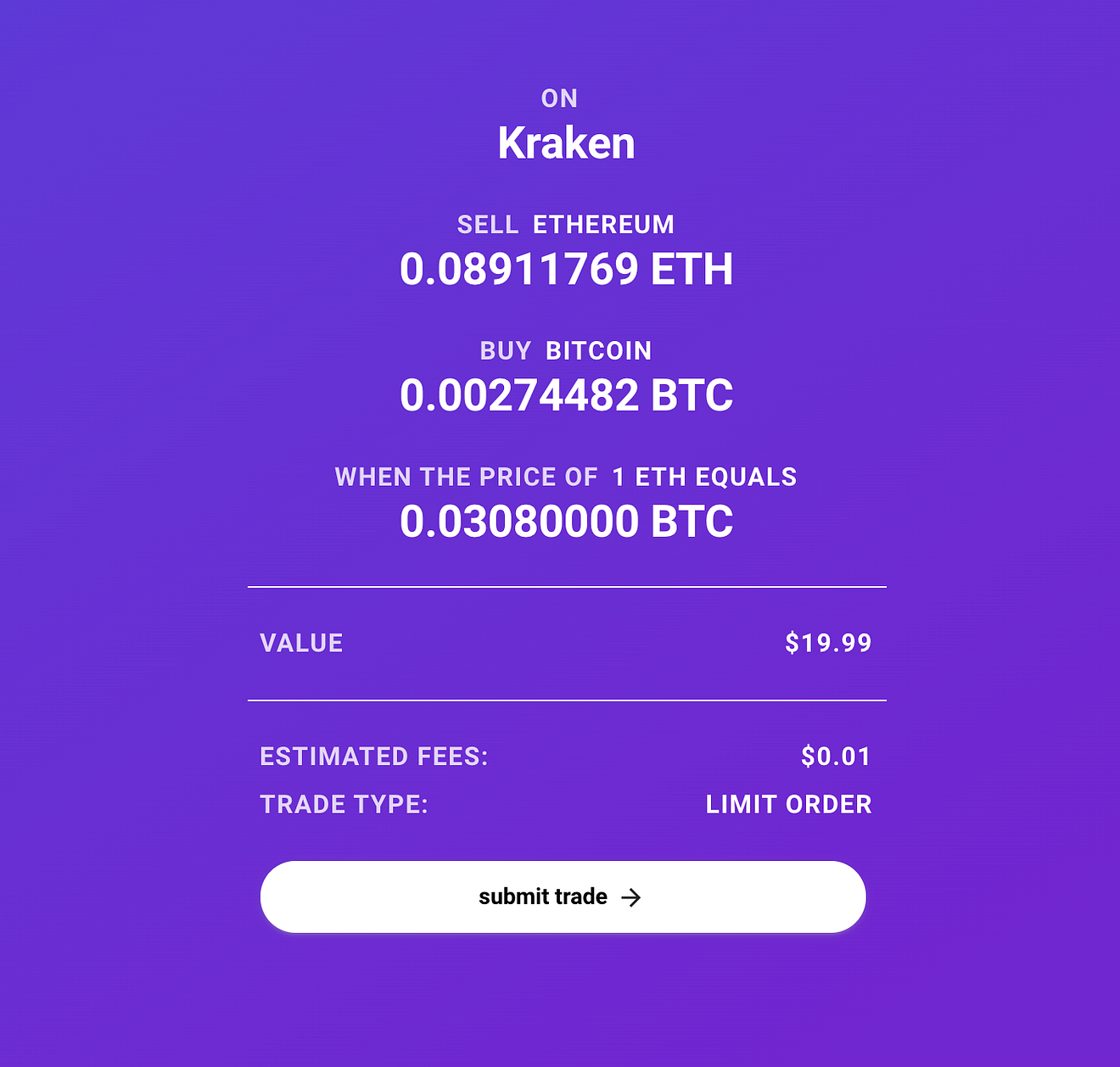

Limit Orders

We’ve recently enabled limit orders for trades as well. This order type will give you some additional information regarding how much the market would need to move before your trade would be executed.

ORDERS

Once you’ve place an order, we’ll track its status, and notify you when that status has changed.

Summary

Our Market, Coin, Discover, and News pages establish a baseline research that helps you understand what an asset is.

After creating an account, our Wallet, Address, and Portfolio pages keep track of what you currently have.

Asset Classes, Strategies, and Allocations can help you figure out what you want to have.

Rebalancing tells how you to get from what you have to what you want.

Our Trade and Order pages allow you to execute your plan and balance your portfolio.

Future

One of the neat things about having all these processes in the same place is that it really opens up some interesting avenues that wouldn’t be available through any other platform.

Multi-hop Trading

Sometimes, you want to sell one asset for another, but neither asset exists on the same exchange. Trading Bitcoin (BTC) for Kyber Network (KNC) for instance, might require you to sell Bitcoin (BTC) for USDT on Kraken, move that USDT to Coinbase, and then sell that USDT for KNC on Coinbase.

This type of trade can be a huge headache, but we’re working on a feature that could effortlessly execute that trading path for you.

…but multi-hop trading also allows us to analyze what trading path would actually yield the best price. For instance, instead of selling that USDT for KNC on Coinbase, placing that trade on Binance might offer you a better rate.

Hardware Wallets & Defi

The ultimate goal is to be able to easily move assets from a secure location (like a hardware wallet), place a trade on an exchange, and then automatically move your new assets back to safety. This drastically improves security, and allows you to become “exchange agnostic.”

Beyond this, we’re currently working with a few DeFi applications so you can keep your assets secure while they’re not being traded, but also earn interest from your holdings by locking them into an interest-earning smart contract.

Taxes

By aggregating all your orders, we can actually separate your buys and sells into lots. Later, when you sell an asset, we can assign that order to a Lot, giving you a lot more control over your taxation rates.

First-in-first-out (FIFO) is the default taxation algorithm. When you sell an asset, any associated gain is based on the last trade you made with that asset. So if you bought Bitcoin at $20,000 in 2017 (Lot A), and again at $6,000 in 2018 (Lot B), and then sold Bitcoin today at $11,000 you would be taxed based on the most recent activity (a $5,000 gain).

With Lots, we can assign that sale to Lot A instead of from Lot B, resulting in a loss of $9,000.

Why don’t other services do this? Well, the catch it that you have to define these order-to-lot relationship within 10 days of completing the order.

Conclusion

Head on over to https://stage.cryptohedgehog.io/ and try it out! We’d love to get your feedback and any ideas for features you would like to see in the future.