Say my name, say my name... it's Taylor, CEO of Hedgehog, back at it again with the white Vans and another newsletter. We help you track and trade your entire crypto portfolio in one spot. Hell yeah.

In the last email I asked for your best Halloween costume ever. Y'all sent way too many awesome answers, and some of my favorites include: a Cascading Style Sheet, Facebook, Wine & Cheese, an over-enthusiastic fan of the movie Seven, full-on human chess set, and Turbo Man.

My actual favorite costume was worn by my co-founder Colton Dillion, who dressed up as the shame nun from Game of Thrones and shamed other Halloweeners who had bad costumes. Twas a fun night. #Shenanigans

If you want a chance to win a Ledger Nano S hardware wallet, don't forget the giveaway question at the end of the newsletter!

🦔 From the Hedgeblog 🦔

You've probably heard of ETH2, the big Ethereum changeover from proof-of-work mining to proof-of-stake, both for scaling and energy efficiency. It's been a work-in-progress for years, and for a long time people weren't sure that proof-of-stake would even work.

By now, other cryptocurrencies have proven that proof-of-stake is a functional model. But Ethereum is still the Big Daddy of programmable blockchains, with a globally distributed team of hundreds of independent volunteers and various small-ish companies. So it’s taken a long time to coordinate changes that won’t break the existing Ethereum landscape. Finally, ETH2 is underway and chugging along.

Also on the main stage is Polkadot's big bet on interoperability. Blockchains should all talk to each other seamlessly… but of course the solution needs to be thoroughly tested first! Maybe that's why a year ago DOT was worth $10 and today it's worth $50.

Ethereum creator Vitalik Buterin is excited about crypto cities:

There are large and very real differences of culture between cities, so it's easier to find a single city where there is public interest in adopting any particular radical idea than it is to convince an entire country to accept it. There are very real challenges and opportunities in local public goods, urban planning, transportation and many other sectors in the governance of cities that could be addressed.

Meanwhile, here's a project with good timing: "Announcing Montanoso! We're building a small village outside Austin that will be owned and managed as a DAO."

Tldr: 60 years from now this might happen, and actually be relevant. Why not sooner? Red. Tape. Don't believe me? Idk this isn't a hill I’m going to die on 🤷

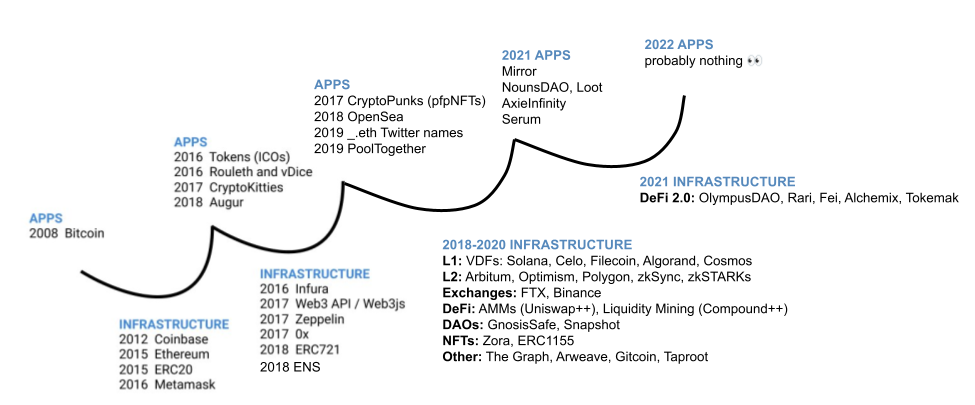

Here is a graphic from "CryptoBoomer's Guide To DeFi 2.0" by Rhys Lindmark:

How do the many names in the picture fit together? Rhys roams all over the place and covers a lot of territory. Just one puzzle piece:

OlympusDAO is built around the idea of Protocol-Owned Liquidity. Instead of liquidity mining, where you give your native token to liquidity providers for providing temporary liquidity, Olympus buys the liquidity outright (through a bond) in exchange for their native OHM token (so the liquidity is "protocol-owned") . It's kind of like a continuous ICO (trading OHM for tokens). It's kind of like an algorithmic stablecoin (the OlympusDAO can issue new OHM backed by its treasury). It's kind of like the Fed on-chain (both hold a pool of assets to back a currency, USD or OHM). No matter the case, OlympusDAO has been incredibly powerful at "sucking" tokens into it. It now has $2.5B locked.

There is waaaay more in the article. OlympusDAO in particular is hot right now, hot enough to be copied: "OlympusDAO's Success Inspires Dozens of Forks."

Tldr: My goodness, crypto is complicated. I know what everything on that graph is, but… I feel weird about it. Have I gone… too deep into crypto? Shit.

A few more interesting links:

"What's a Ponzi Scheme? What Isn't?"

Tldr: Do 👏 Your 👏 Own 👏 Research

"A conceptual unlock that made me get the excitement about web3: stackability 📚" — Nathan Baschez

Tldr: #StackSats... among other things!

"Network intersubjectives" — "I've been thinking about how the structure of a network shapes the flow of money, and the distribution of power within that network."

Tldr: Greed is good, money never sleeps, buy high, sell low, etc.

"How to borrow and lend any token" (at your own risk, I must add!!)

Tldr: DeFi is dope. Complicated, but dope.

"How Bored Ape Yacht Club Created a Billion-Dollar Ecosystem of NFTs"

Tldr: #ThanksObama

"Loot is a viral social network that looks like nothing you've ever seen"

Tldr: Also, 10 reasons why clickbait titles are literally the worst (you'll never believe #6)

"Squid Game Cryptocurrency Scammers Make Off With $3.3 Million"

Tldr: What if they just… won the squid game, tho?

Giveaway question! Reply to this email for a chance to win a Ledger Nano S hardware wallet. What I wanna know is: what's your favorite sandwich?

Whether you make it yourself or know a place, give me the full run-down. Burritos count. Bonus points if you have the recipe.

Don't forget, you're my #1 customer,

Taylor

To get future newsletters delivered straight to your inbox every week, sign up here!