Hi, it's Colton from Hedgehog, the friendliest platform for sophisticated crypto investment strategies.

Way of the Wallet

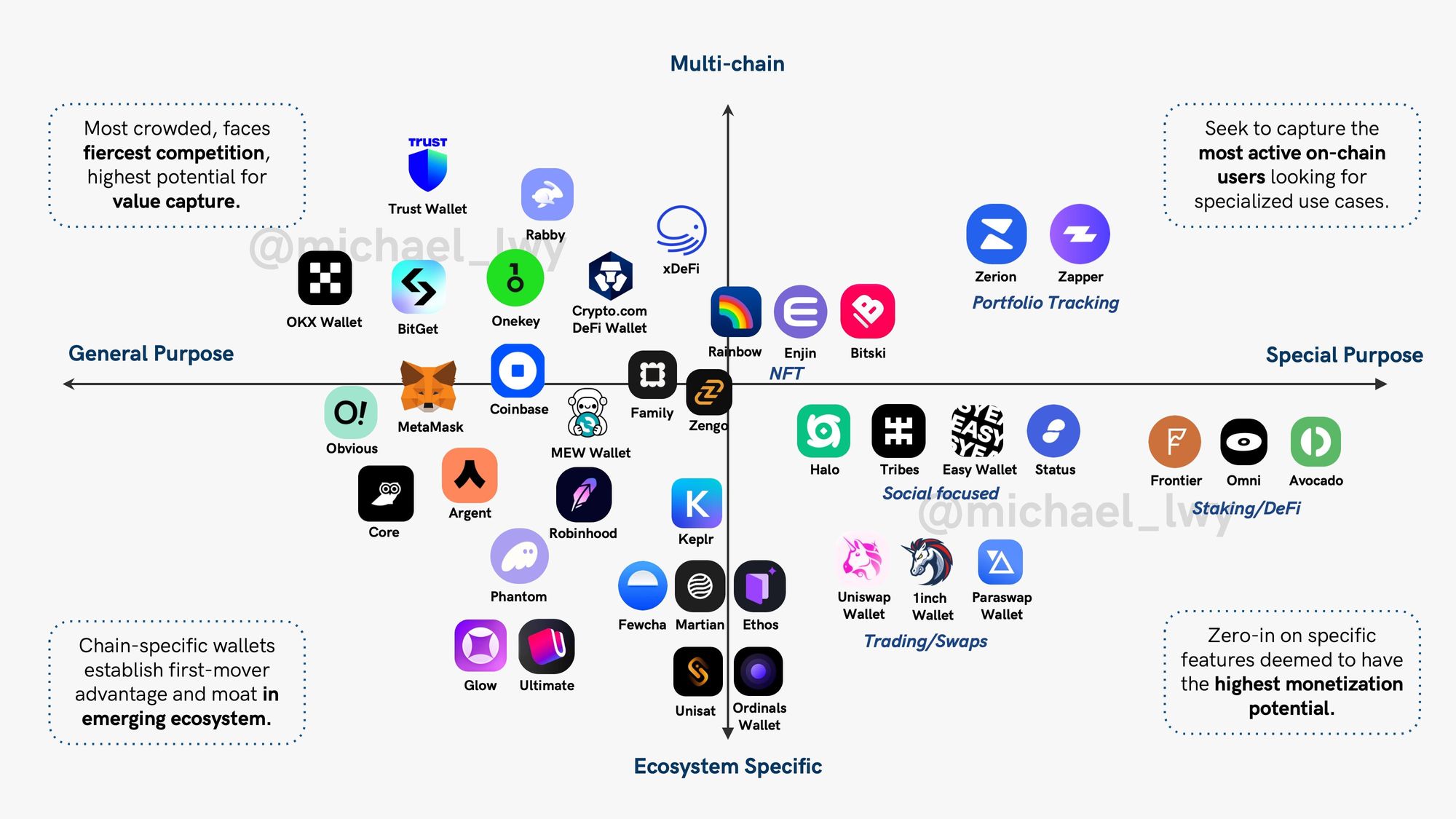

From Michael Lwy, a fascinating analysis of the crypto wallet landscape:

"Wallets are powerful gatekeepers in this ecosystem, compiling user intents into on-chain actions," he observes. In other words, where there's a will, there's a wallet. When you're doing something with crypto — buying, selling, staking, and so forth — it's highly likely that a wallet is involved. Thus wallets dictate the behavior of crypto users. But also vice versa, because wallets compete with each other by facilitating the behavior that users want to pursue. There's a constant push and pull.

BoxCoin Hype

We may or may not be gearing up for another bull run. No promises either way. But if we are, it would behoove everyone to remember the lessons from the last one, elegantly described by Matt Levine:

The basic mechanism of a lot of decentralized finance projects is a Ponzi scheme with some fairly standard complexification:

1) You invent a token, BoxCoin or whatever, and sell it to people.

2) People who own BoxCoin get paid a yield — "APY," for "annual percentage yield," is the standard term — in BoxCoin, or perhaps in some related crypto token.

3) Like, you know, every 12 hours you get 10% more tokens or whatever.

4) People are like "look at how high the yield on BoxCoin is, I'd better get some."

5) They buy it, and the price goes up.

6) Now the yield looks even better: Now you have 100 BoxCoins worth, like, 2 cents each, but in 12 hours you'll have 110 BoxCoins worth 3 cents each. What a yield!

The trick is … I mean, it is all a trick … but one trick is to hype it up and get people to buy BoxCoins, so that yield looks like an actual monetary yield rather than just the proliferation of worthless numbers, and the other trick is to get people not to sell BoxCoins, because if they sell it all collapses.

Levine went on to list a few examples of this phenomenon — Hex, Terra and Luna, OlympusDAO — and to comment, "I cannot adequately express how insane 2021 was."

Will 2024 be insane too? No one knows for sure. But if it turns out to be a rollercoaster, best to be prepared; resist the FOMO and hold onto your hat. Granted, future schemes may look a little different from the previous cycle, at least outwardly. "Too good to be true," however, is eternal.

Quick Hits

A couple more links for your perusal:

- Grayscale Chainlink Trust Shares Rocket To 200% Premium

Grayscale has been so interesting lately. This seems to indicate a fair bit of pent-up demand for institution-friendly crypto products.

- Binance Launches Self-Custody Crypto Wallet With Exclusive 'Airdrop Zone' for Users

Speaking of wallets! This is an interesting mechanic:

Instead of having to use a seed phrase, the wallet uses MPC to generate three separate key-shares. One is protected by Binance itself, one is held on the user's device and a third is encrypted through a recovery password and saved on either iCloud or Google Drive.

Access to the Web3 wallet requires two of the three key-shares, so if one is lost or compromised the user can still gain access to their funds.

Binance is aiming for a "best of both worlds" solution to wallet security. Will you try it out?

Until next time, keep hedging,

— Colton

To get future newsletters delivered straight to your inbox every week, sign up here! Check out past newsletters in the complete archive.