Oh hi! It’s me, Taylor, your friendly neighborhood CEO of Hedgehog. What’s Hedgehog? We’re one of the first companies registered with the SEC to provide personalized crypto advice in the U.S., and for our v2 launch, we’ll be helping users to buy baskets of currency in a single deposit, build their own crypto indices, and take advantage of our unique auto-rebalancing and best-execution trading system.

Oofta! Now that the pitch is out of the way, let’s talk about Consensus! It’s the reason why this newsletter is a happy hour special, hope you didn’t miss me over coffee! Btw, the giveaway question has to do with something you might get at happy hour… but not what you think! Answer the question at the end and you might win a Ledger Nano S hardware wallet — more relevant than ever given the headlines about exchanges “pausing” deposits! Okay, now that that pitch is out of the way…

Last week I moderated what I can only describe as a stacked panel with Liz Young (Head of Investment Strategy at SoFi), David Duong (Head of Institutional Research at Coinbase), and Jeff Dorman (CIO at Arca). We came on right after an intense conversation with the Chairman of the CFTC. Was I nervous? Absolutely. Did it look like I was nervous? Also: Absolutely. Still a wonderful conversation overall! I was assured that the video will be available at some point.

This year Consensus had quite the “Suits!” vibe if ya catch my drift, but we were honestly surprised by just how much interest there was for what we’re building, and can’t wait to start demoing! The best conversations happened at the side events, and huge shoutouts to Haseeb Qureshi (Dragonfly Capital), James Sutton (Frabric), Marc Hochstein (Coindesk), and the crew at Messari (I had a bit of a fanboy moment there) for just an all-around fantastic event experience.

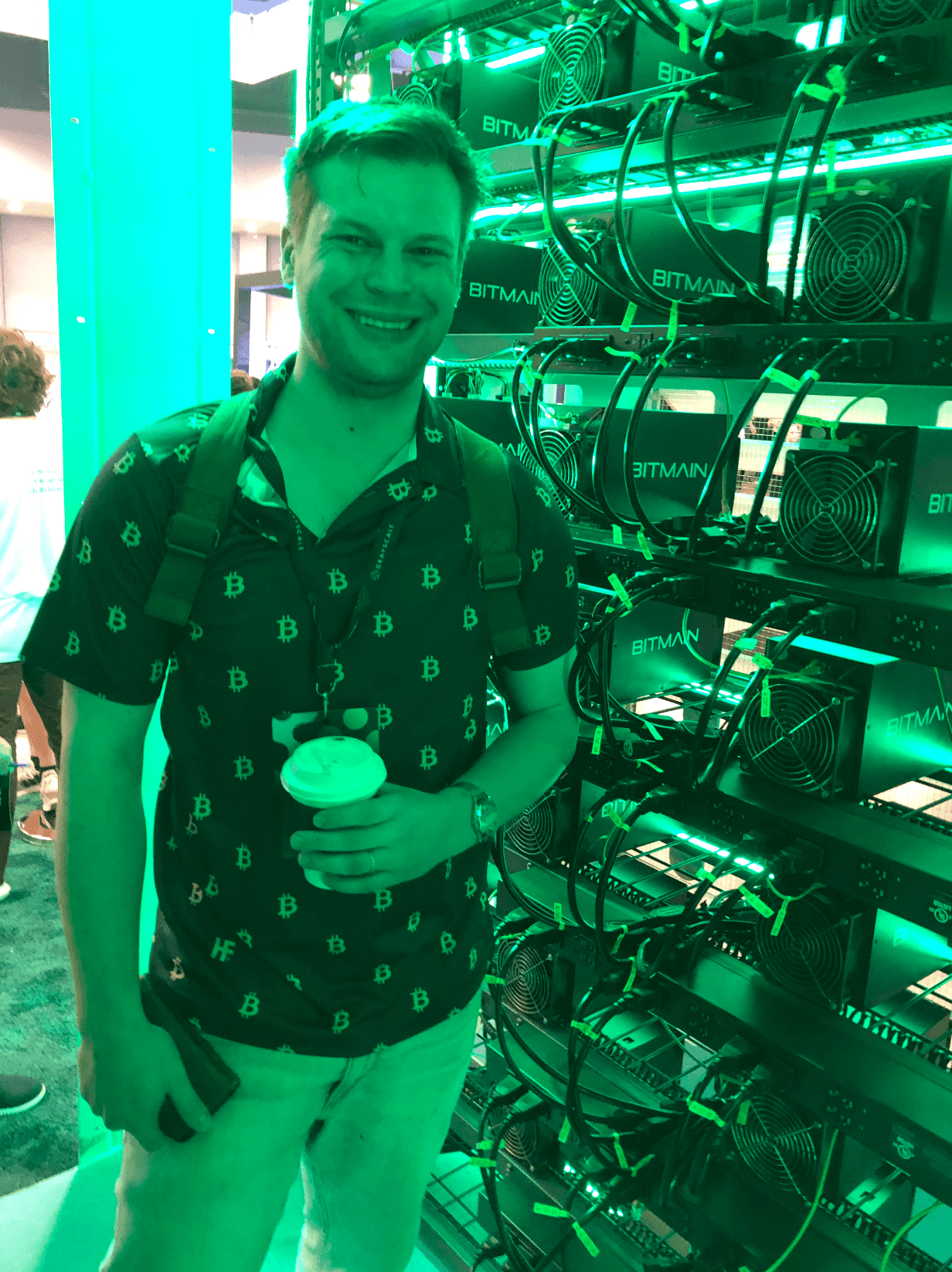

Here I am in my bitcoin shirt, bathed in the green glow of an AntMiner installation:

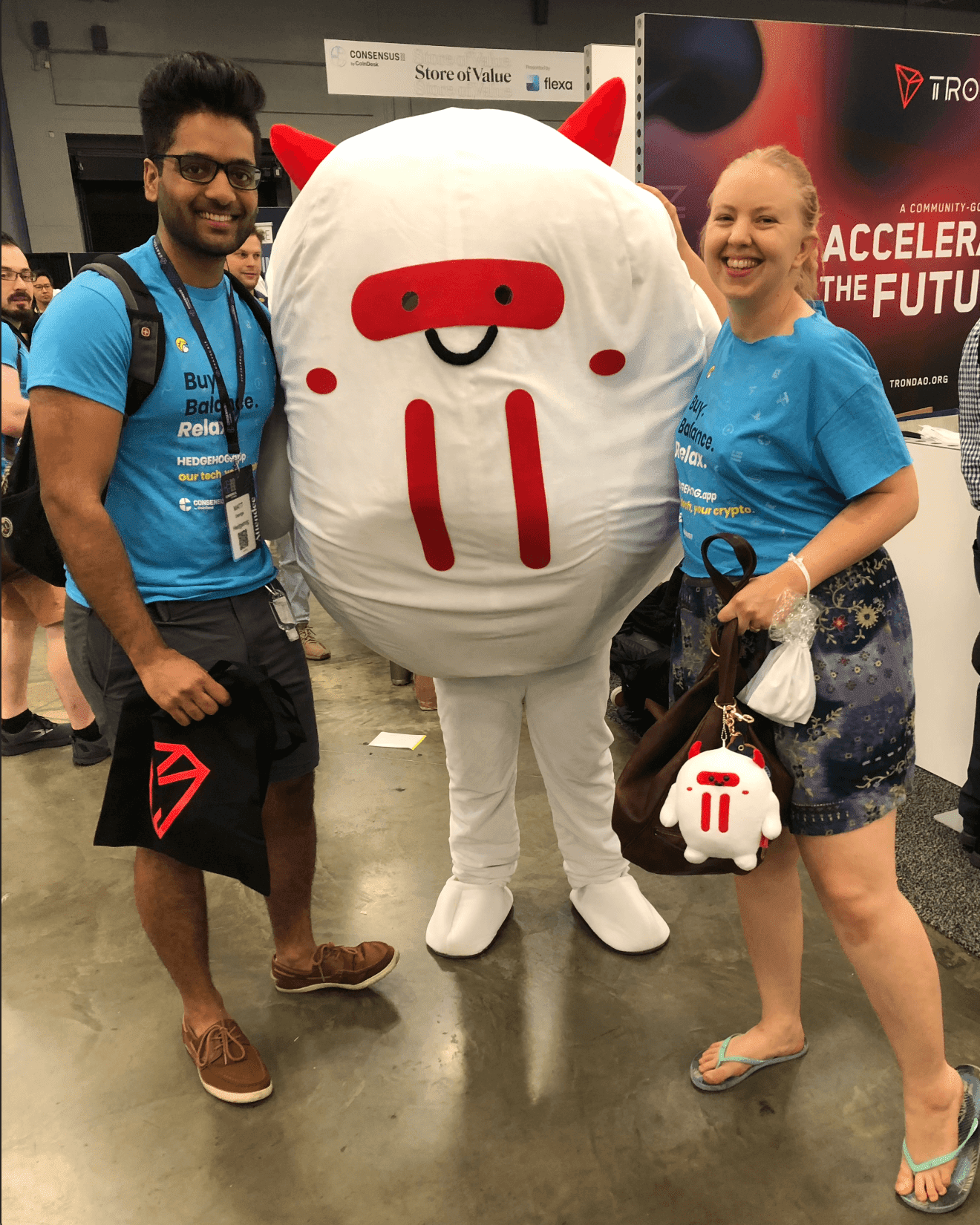

And here are Matt and Sonya with the Tron Bull (I dunno man, the plushies were cute):

Now then, let’s get into the rest of crypto.

Sooo about that bear market. I think the bear is growling? He might be angry.

The biggest story right now is that DeFi bank-ish-but-not-actually-a-bank finance thing Celsius began imploding. (All DeFi products are heretofore known as “finance things.”) On Reddit people are calling it a rug (scam) and bringing up Mt. Gox, but who knows at this point. The situation does sound dire, with the Wall Street Journal explaining:

Prices for bitcoin and other cryptocurrencies have been plummeting as interest rates rise and risky assets turn unpopular. The difficult market is forcing once-highflying digital-currency companies to slash jobs, halt mergers and bar clients from withdrawing digital investments, shocking investors.

Individual investors might not have realized when they put money in Celsius that they were giving the company an unsecured loan with little legal protection. Crypto companies such as Celsius look like banks in some ways, but they lack the investor oversight and legal protections built into banks and brokerages.

In a blog post Sunday evening, Celsius said it was pausing all withdrawals, swaps and transfers between accounts, citing “extreme market conditions.” The move froze $11.8 billion in customer assets, based on the company’s May report. On Wednesday afternoon, the assets were still frozen, and Celsius founder and chief executive Alex Mashinsky tweeted that the firm was “working nonstop” on the issue.

Tldr: I think I speak for all of us when I say, Yikes.

Meanwhile there’s another $1+ million DeFi hack, but those seem to happen every week, so whatever. Is anyone even fazed at this point? (Probably the people who lost money. That always sucks.)

Here’s what I had to say the last time prices plunged, which was uhhh [checks watch] a month ago:

While past performance is no guarantee of future returns [...], another way to look at market crashes is that assets are on sale for the next growth cycle. Exchanges out here lookin’ like JCPenney with all these 15% dips. Granted, it’s hard to time the bottom, so it’s totally possible to buy your favorite cryptocurrency and then watch the price keep sliding. Bitcoin and ethereum have also provided ample opportunities for that experience throughout their history! And some altcoins will never recover, just like some companies go bankrupt and disappear during a recession.

I stand by that. Also, all this volatility makes it the perfect time to plug Hedgehog’s dollar-cost averaging strategy guide again. And remember how I said “we’ll be helping users to buy baskets of currency in a single deposit, build their own crypto indices, and take advantage of our unique auto-rebalancing and best-execution trading system”? Yeah, watch this space.

Tldr: Stay safe out there, and don’t try to time the market.

As a CoinDesk headline opined, “No One Is Saying 'Crypto Winter' at Consensus.” Crypto may be a rocky rollercoaster, but the industry is here to stay. Regulators are starting to wrap their minds around this sector of finance — an imperfect process, I’ll be the first to tell you, but a sign that Satoshi’s invention and its ramifications are still only beginning to unfold. We’re still early, as people like to say.

Tldr: *whispers* Bull… ish *more whispers*

Meanwhile, Elon Musk is being sued over Dogecoin.

Tldr: Ahhh, America.

And now, the moment you’ve all either been waiting for or skipped to: The giveaway question of the week! Want a chance to win a Ledger Nano S? Just reply to this email with your response to this question:

What’s the best piece of swag you’ve ever received from a conference? If you haven’t been to a conference, the best piece of promotional swag in general.

At least my bags are reusable,

T

To get future newsletters delivered straight to your inbox every week, sign up here!