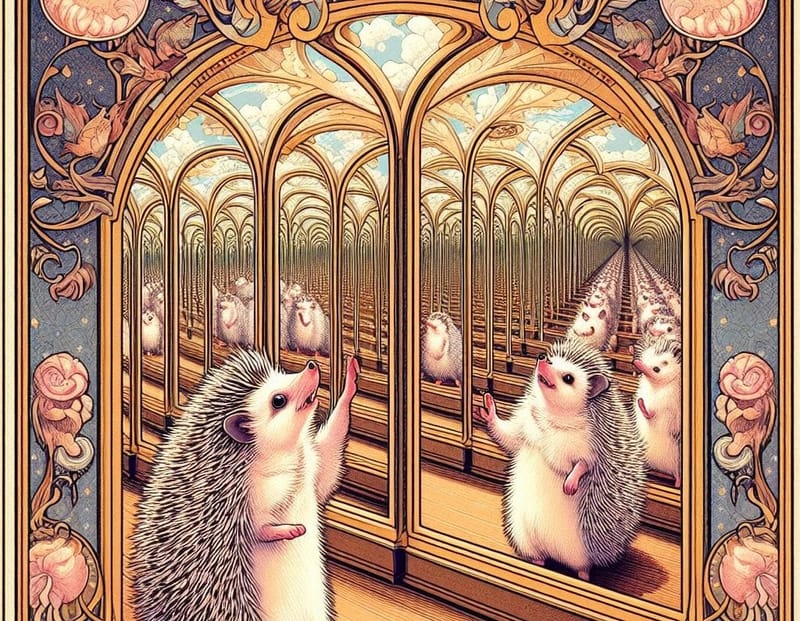

An infinite regress of greetings to you all, this is Colton from Hedgehog, the app that helps you buy baskets of cryptocurrency and automate your digital asset exposure wherever you custody funds.

Finance by its nature is very incestuous, in that the full value the industry provides is connecting individuals to assets when they need it. Brokers try to connect buyers to sellers and sellers to buyers, and they themselves act as buyers and sellers ad infinitum to help people discover the best price for specific assets where and when they need it.

In aggregate, this leads to you getting access to exotic fruits, like mangoes, avocados, and sugar cane, at reasonable prices even though you live in the middle of an inland desert. It is a modern miracle! But sometimes we can disappear up our own you-know-whats-its because we get a little too clever trying to sell kiwis in the Negev.

The snake eating its tail

It turns out that 25% of all Ethereum is being staked by validators in the protocol's EigenLayer that secures the chain against double spend attacks. Now, normally this would be incredible news: the owners of 1 in 4 Ether tokens are choosing to use that capital to secure the protocol against liars and cheats. But unfortunately, most of those 1 in 4 tokens are being held by major institutions and rehypothecators who are wrapping the tokens and using them as collateral to get more liquid cash back.

A full 31% of these tokens are locked up in the LDO protocol, and many tokens are now being locked in similar “restaking” protocols, like PENDLE or FRAX, that give stakers access to liquidity between lock-up periods. While this is great for end consumers, who now can lever up their positions to take advantage of other yield opportunities, it kind of defeats the purpose of a Proof of Stake system.

In Proof of Stake protocols, you put your money where your mouth is, so if someone catches you lying about what transactions occurred, they can tattle on you to the rest of the validators and the validators can slash your stake, stealing away the money you put up against your word. But with liquid restaking protocols, you end up hiding away those who really run the validator nodes, and you give node operators a method of reneging on their stake by wrapping the token and selling it out to somebody else. If you don’t have any opportunity cost for locking up your tokens, what do you have to lose for lying about the claims backed by your stake?

Now, Vitalik has written about all this before, so it’s no surprise to the devs behind the protocol. But we are starting to see an existential risk to the balance of validators in the protocol, and the community will have to stop eating its own tail if it wants to remain a reliable option as other ecosystems like SOL, DOT, or ATOM, grow in sophistication.

Shedding skin in the game

According to CoinLedger via The Block, most of their clients using the software realized less than $1,000 in gains in 2023, which is up from realized losses of $7,000 in 2022. Now before we clutch our pearls at those disappointing realized gains, keep in mind that most people are trying not to realize gains so that they don’t owe taxes on them. After all, 93% of all unspent transaction outputs (“UTXOs”) on the Bitcoin network are profitable!

That means that the majority of Bitcoin holders, which may not generalize well to all crypto holders, truly are HODLers and specifically don’t transact their crypto unless it’s to realize a loss that they can claim on their taxes. If you need tax assistance, Hedgehog is partnering up with a provider to give you a hand for 2023, so keep an eye out for that announcement.

The riddle of steal

Prometheum has announced its initial asset launch for its new special purpose broker dealer will be Ethereum. Most intriguing of all is that it might force a fight between the CFTC and the SEC over Ethereum’s status as a security or a commodity. Will the SEC be able to steal jurisdiction from the CFTC? Only Thulsa Doom knows.

I read this article from Byrne Hobart and liked its accessible explanation of Kelly Criteria. How are you treating your true bankroll? I’m definitely allocated into much riskier assets between startup equity and cryptocurrencies, but I figure I’m still young and most of my assets are in unearned future income!

Keep hedging,

— Colton